If you are exporting your data to an external accounting package, ensure you have set up the External Account information in GL Account Setup. The software uses the External Account information as the default format for your accounting system.

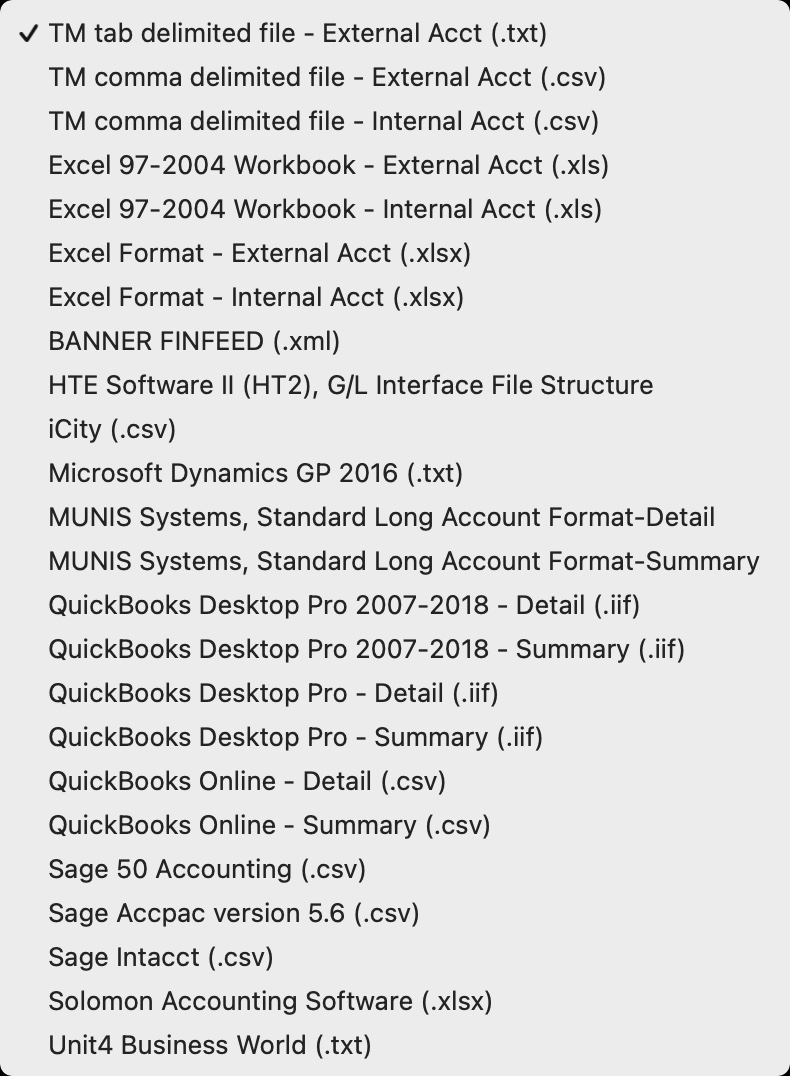

There are several export formats available to suit a variety of common accounting softwares. The export format is set in [Company Preferences >> Accounting Tab](/reference/company-preferences#accounting-tab. The current options are:

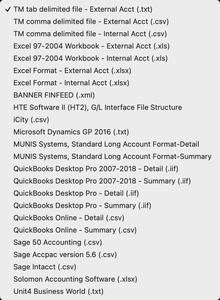

Tab Delimited G/L Export Format Top

TM's tab delimited file format works with most accounting packages and with Microsoft Excel. Each field is separated by a tab.

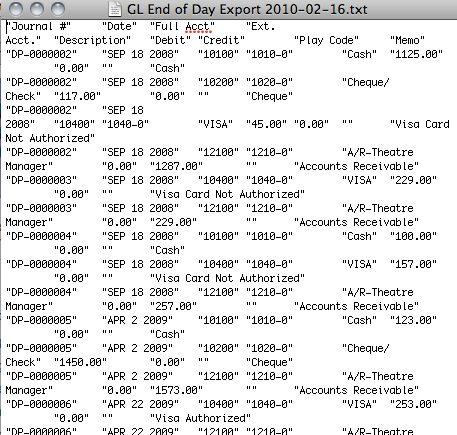

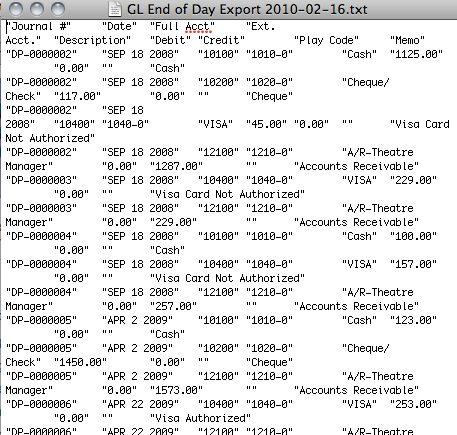

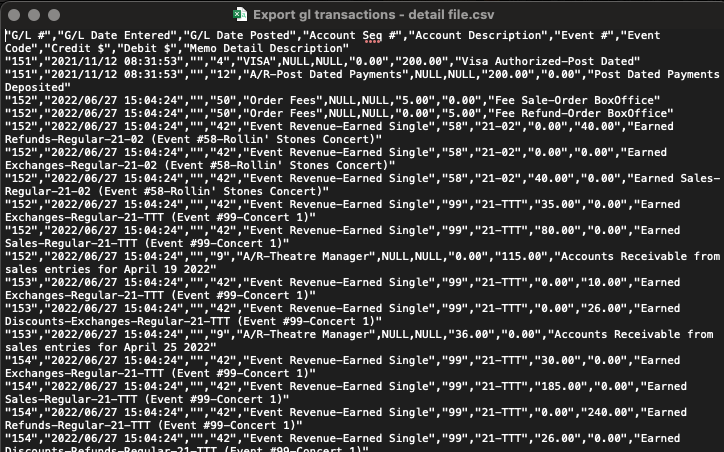

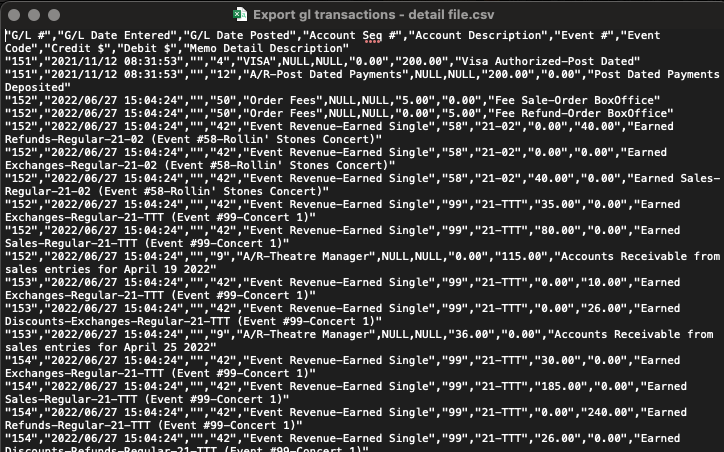

Comma Delimited G/L Export Format Top

TM's comma delimited file format works with most accounting packages and with Microsoft Excel. Each field is separated by a comma.

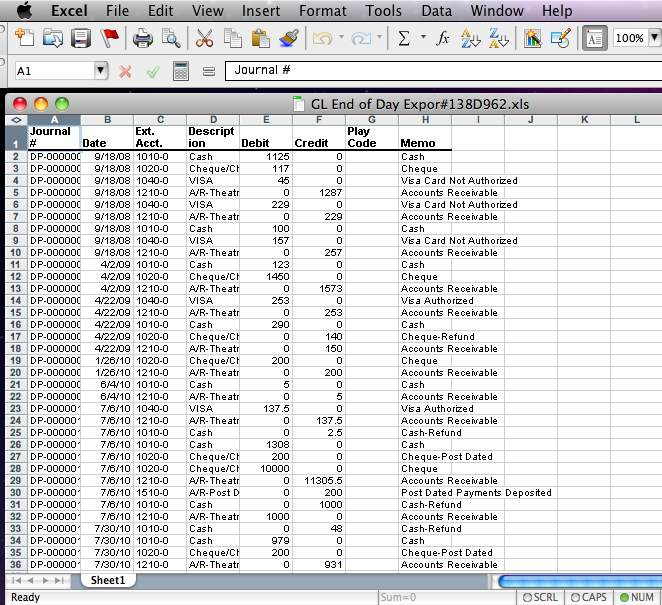

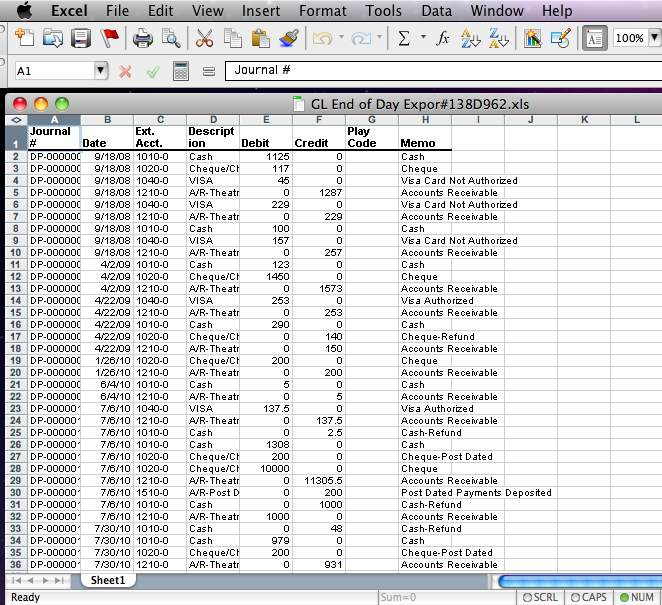

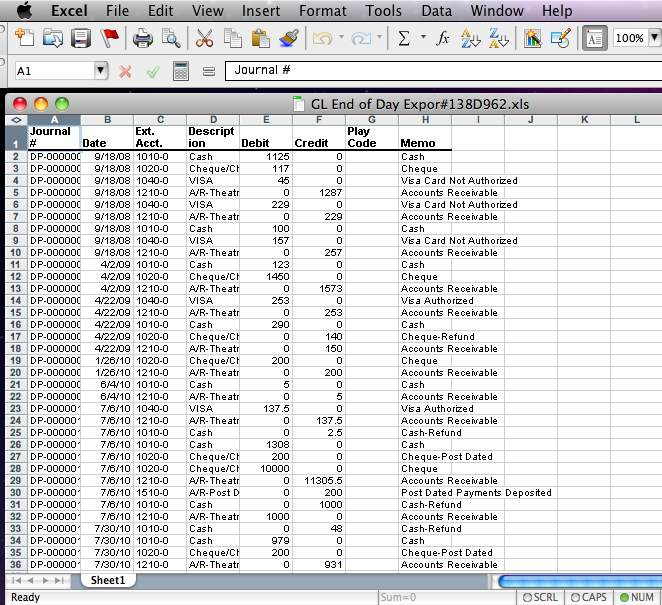

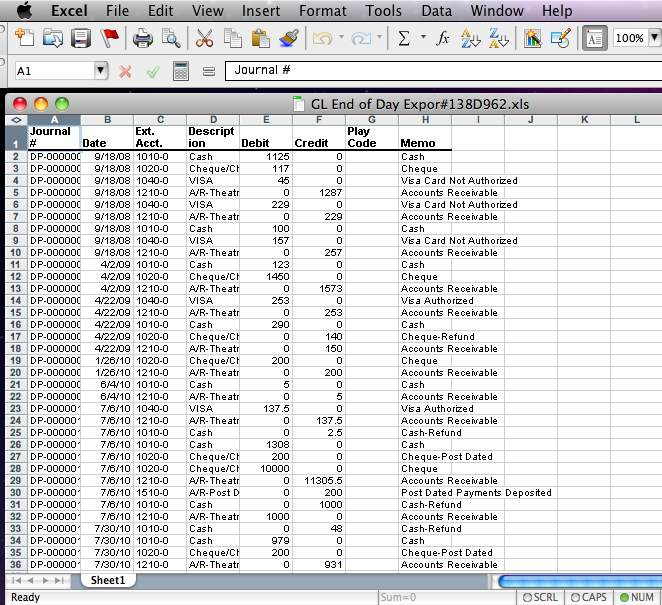

Excel G/L Export Format Top

Excel Workbook 97-2004 creates a .xls export file that can be opened directly in Microsoft Excel versions 97 through 2004 with no need for conversion.

Excel Workbook 2008 creates a .xlsx export file that can be opened directly in Microsoft Excel 2008 and higher with no need for conversion.

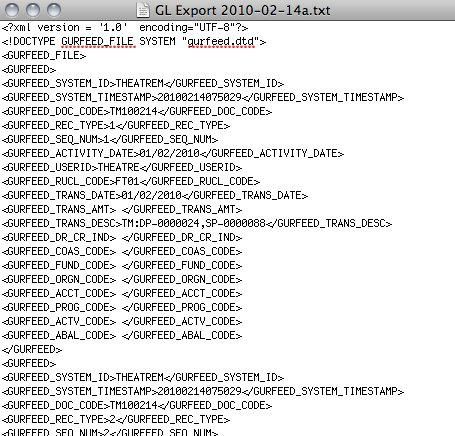

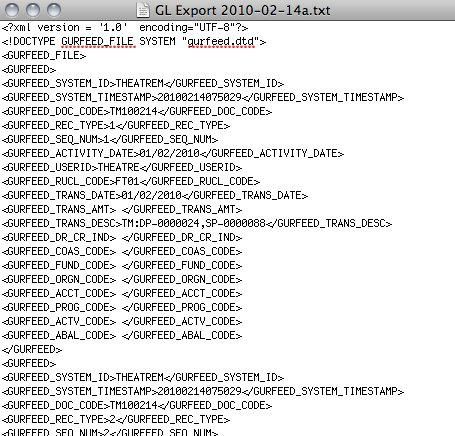

Banner G/L Export Format Top

Banner FINFEED creates an .xml export file for use with the Banner financial package. If your organization uses Banner, then select this option.

HTE Software II G/L Export Format Top

HTE Software II Format

HTE Software II (HT2), G/L Interface File Structure creates a fixed position file format.

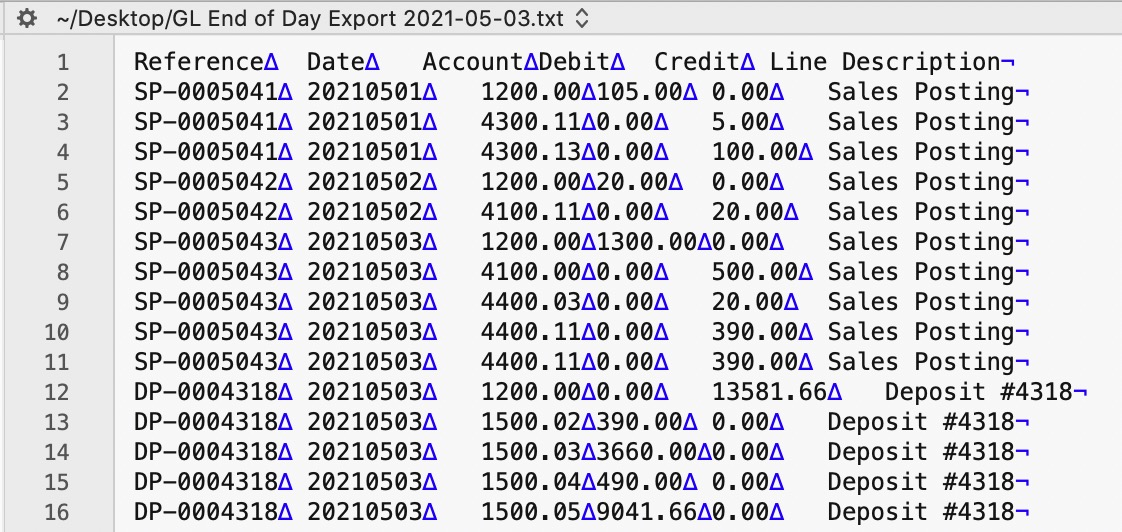

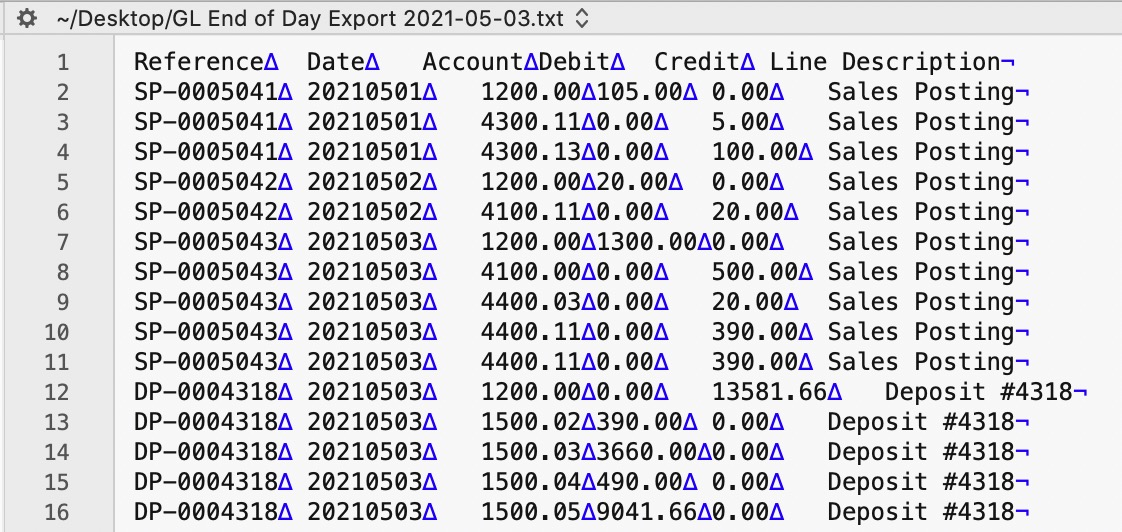

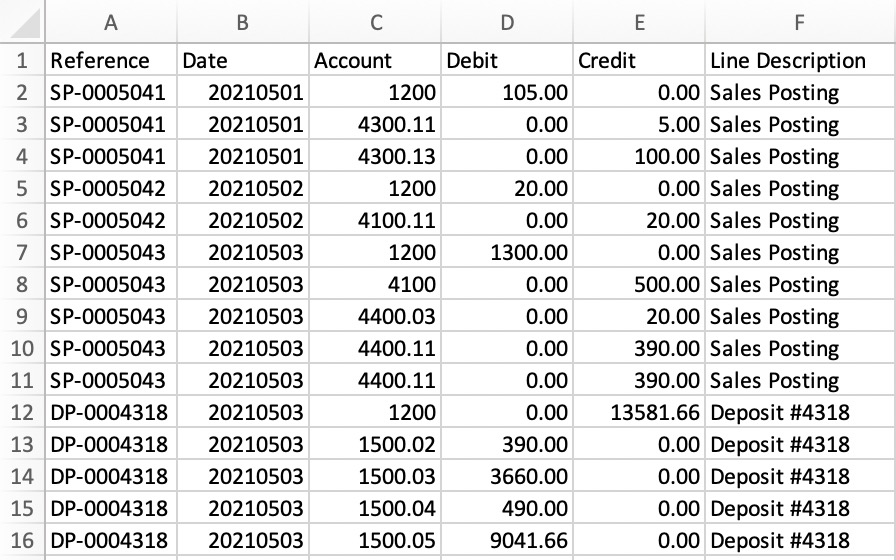

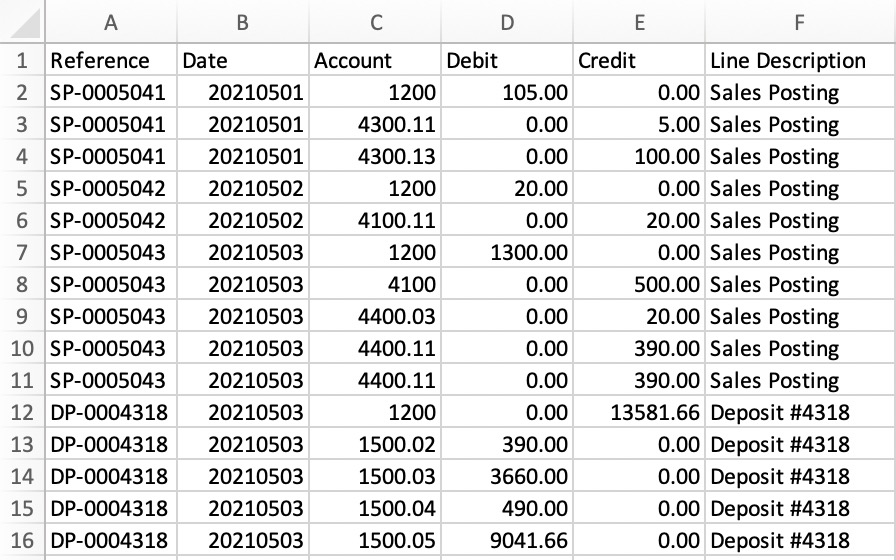

Microsoft Dynamics GP 2016 G/L Export Format Top

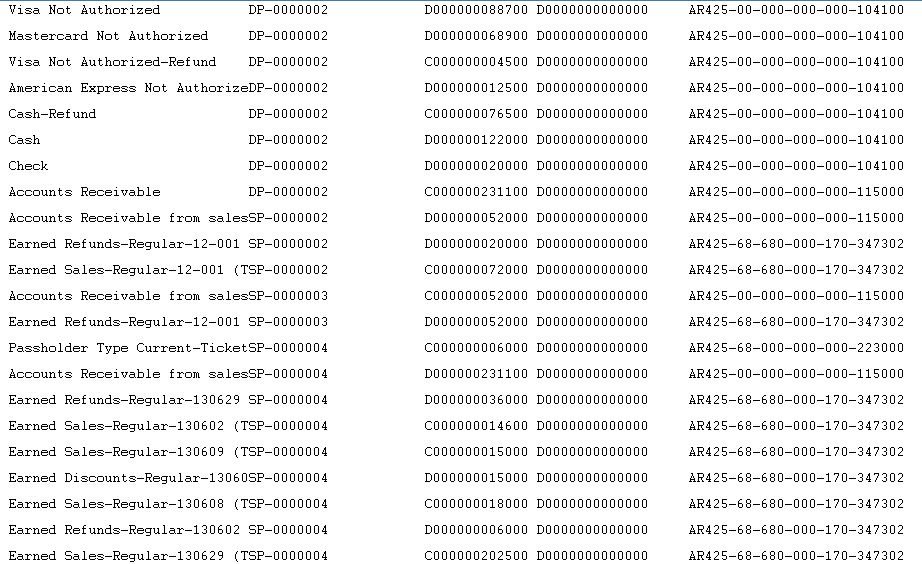

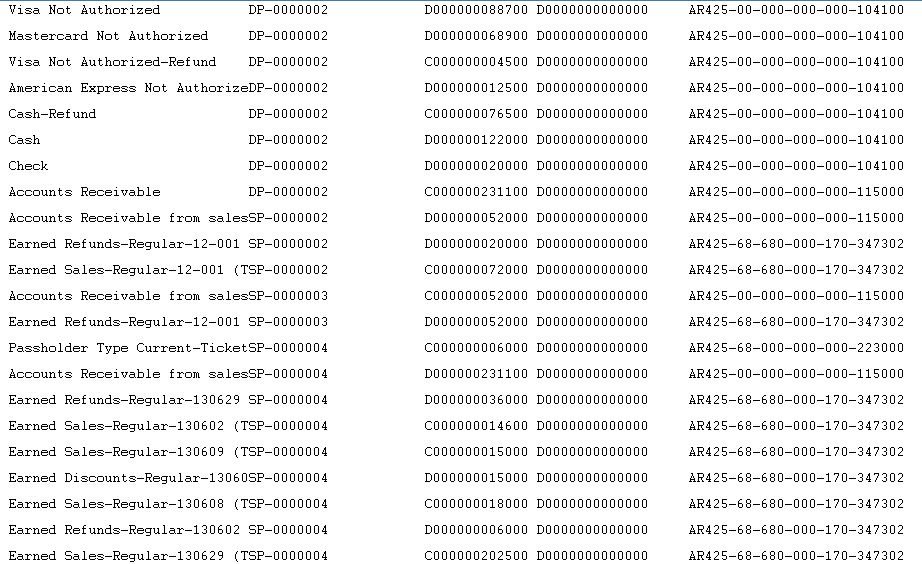

The Microsoft Dynamics GP 2016 exports a tab-delimited text file containing an export line for each detail line within the G/L Entry. The deposit and sales posting are combined and exported within the same export file. This allows an exact match of each G/L Entry to crossover into Microsoft Dynamics GP 2016 accounting software (line for line).

Parts of the Microsoft Dynamics GP 2016 Export File:

- Reference: The Journal Entry Reference Number (e.g. SP-0005041, DP-0004318, GL-2021122).

- Date: The Journal Entry Date, always in YYYYMMDD format.

- Account: Theatre Manager's External Account value (name or number), used to create the export file.

- Debit: The Debit Amount for each G/L Detail Line.

- Credit: The Credit Amount for each G/L Detail Line.

- Line Description: the Journal Entry Description for each G/L Entry (e.g. Sales Posting, Deposit Posting, etc)

iCity G/L Export Format Top

Theatre Manager will create a comma-delimited text file (.csv) that can be used to import into iCity accounting software. iCity's ability to create unique funds, classes, departments, and objects for each G/L account requires the setup of Theatre Manager's External Account field to be set in a specific format to accommodate the various aspects of the iCity export file, prior to performing the first export.

The iCity - Detail format will export each detail line within the G/L Entry. Each deposit and sales posting are exported as their own separate entry within the export file. This allows an exact match of each G/L Entry to crossover into iCity (line for line).

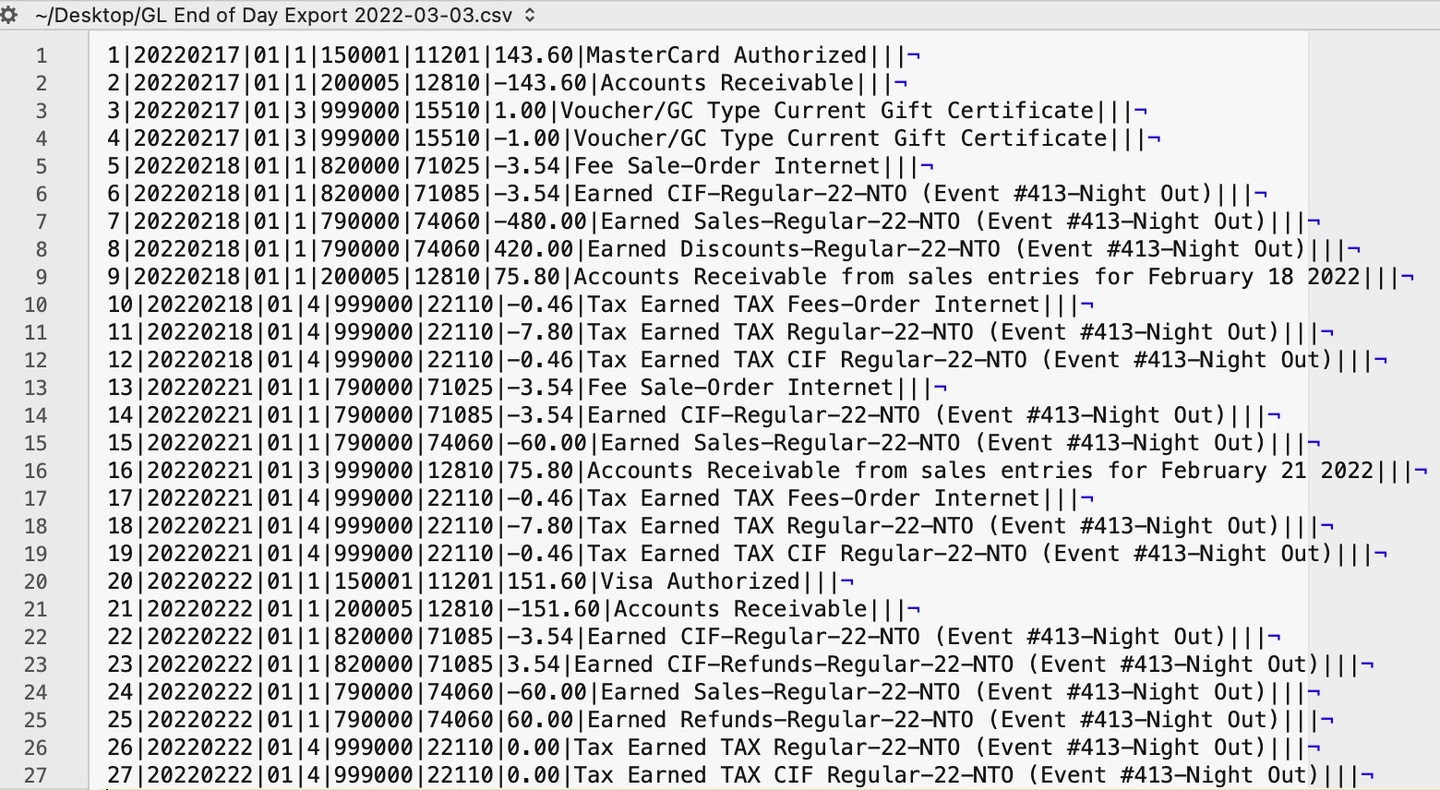

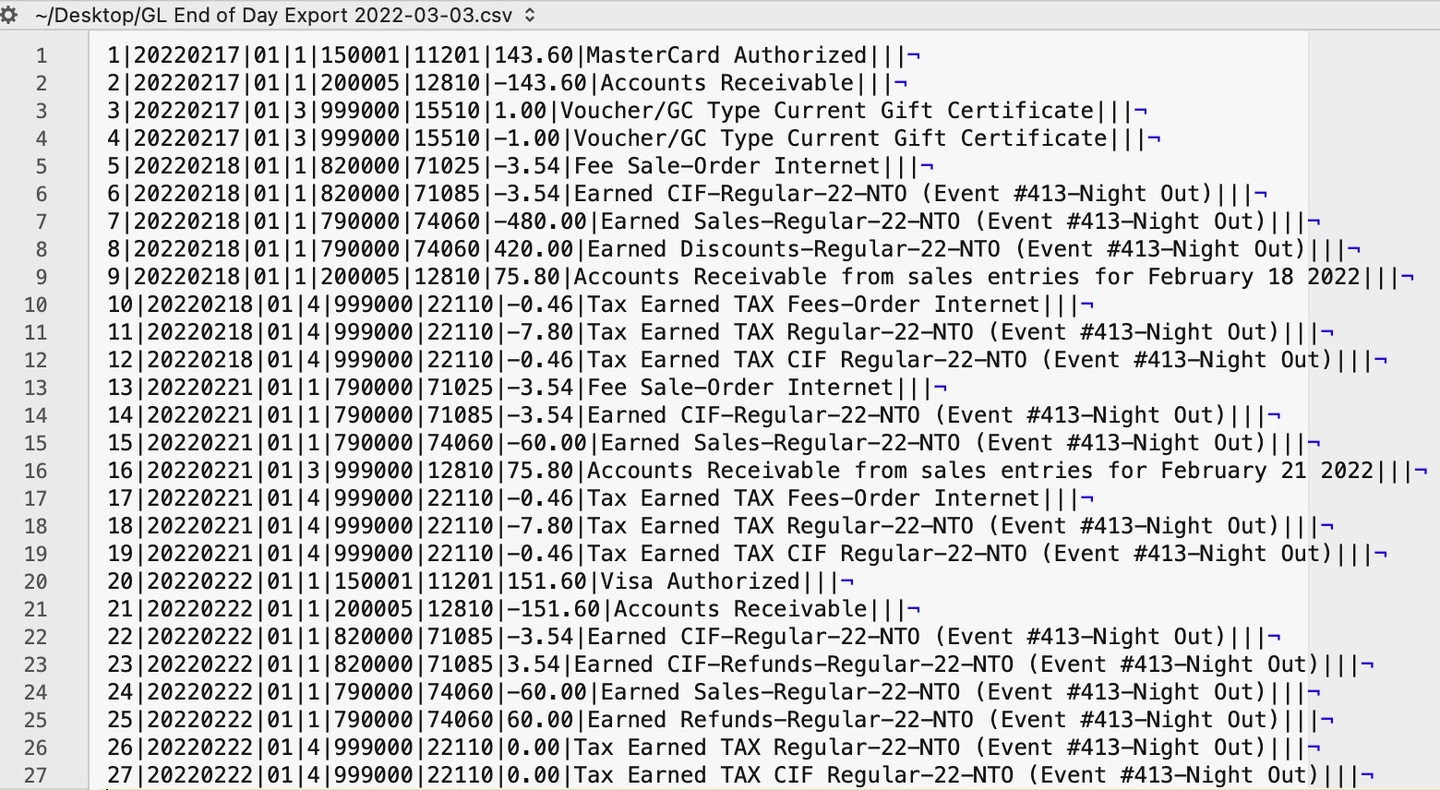

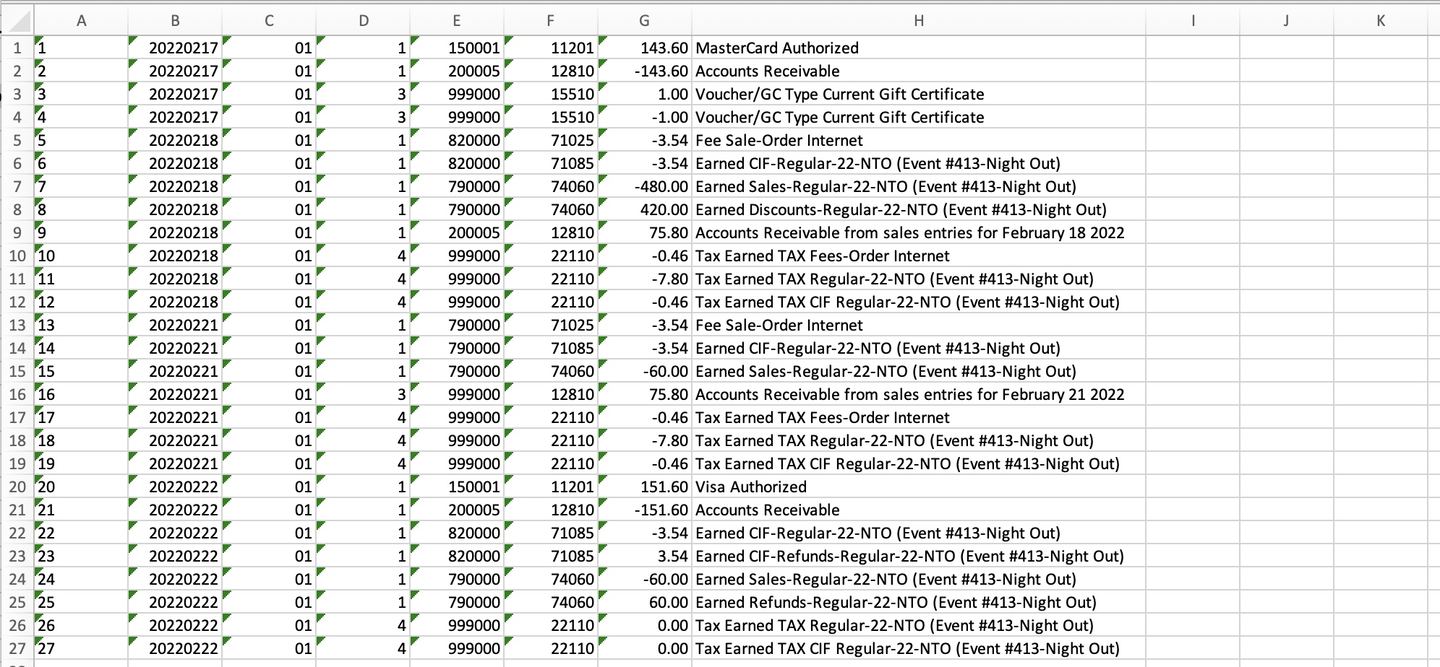

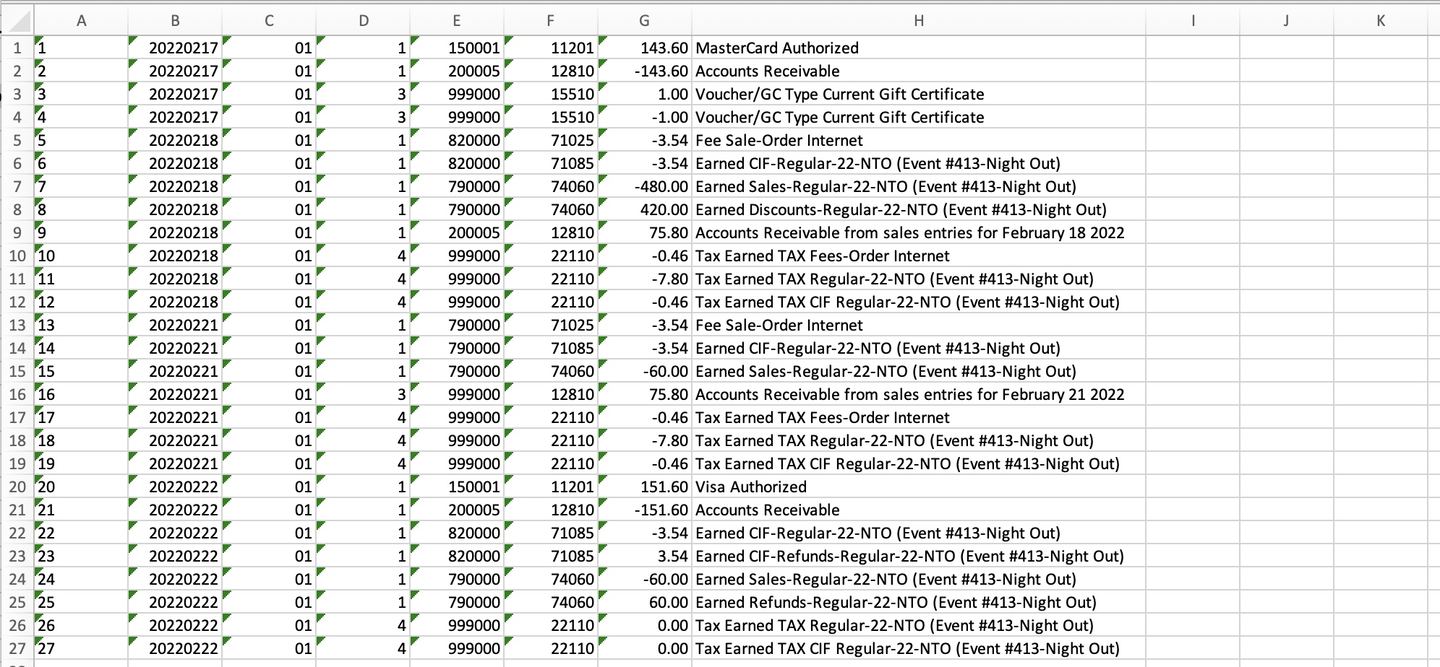

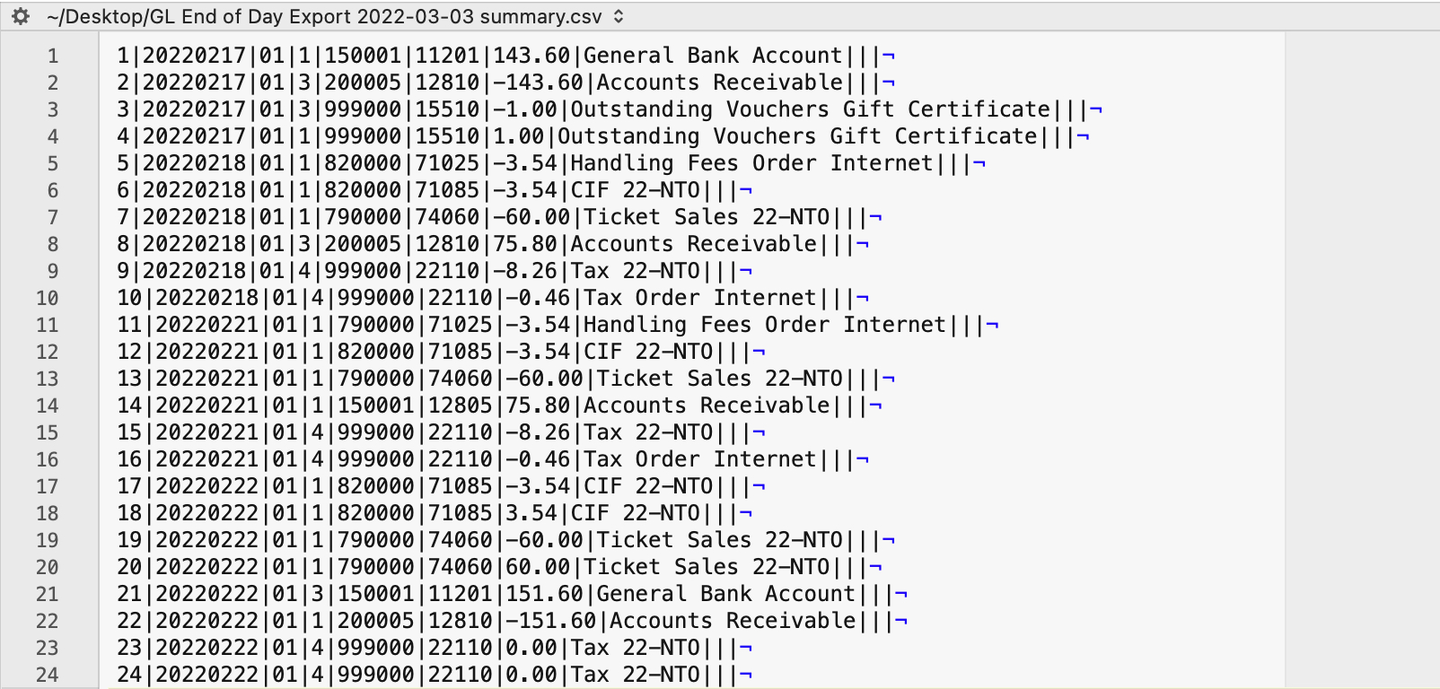

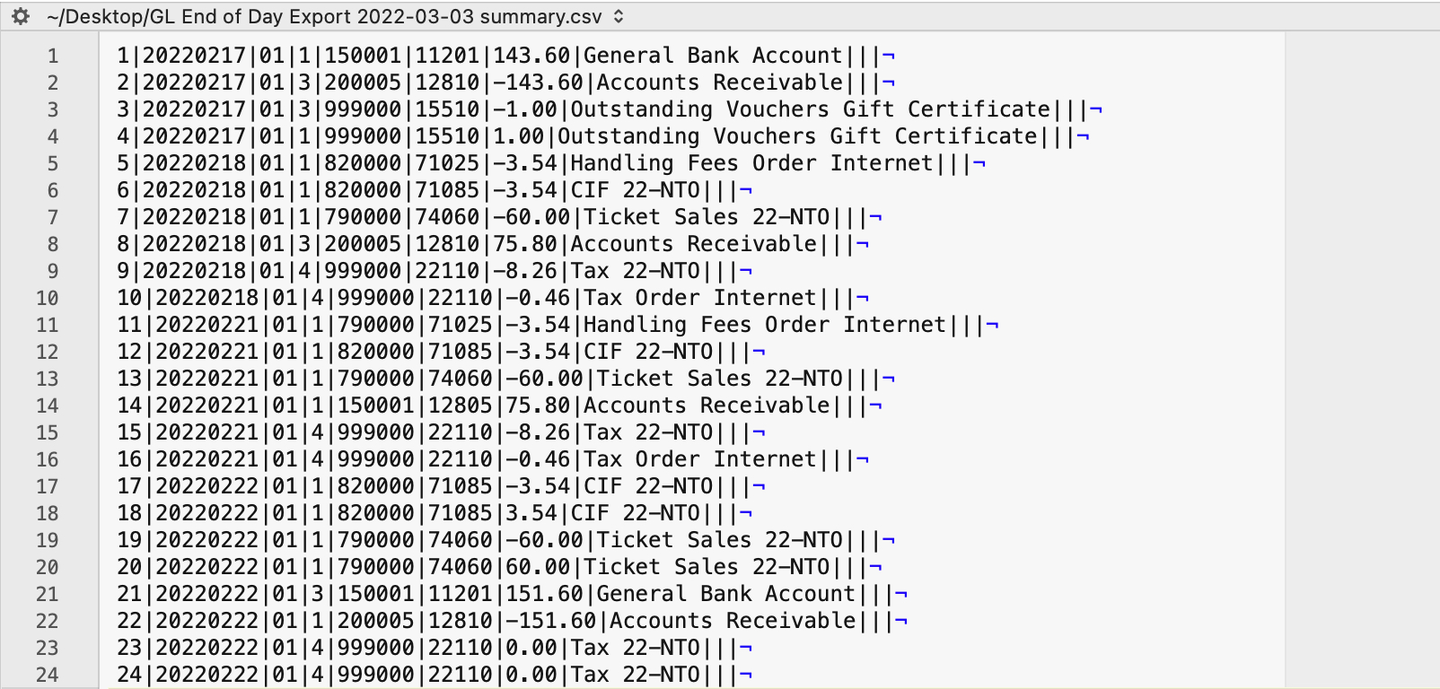

Parts of the iCity Export File:

- Voucher ID: A sequential Line Counter for each exported entry line, beginning at 1 and incrementing by 1 for each associated entry line.

- Date:* The Journal Entry Date for each G/L Entry in a YYYYMMDD format.

- Fund: An associated Fund Code to the Account Number. Theatre Manager's External Account value (name or number) will be used to create the export file.

- Class: An associated Class Code to the Account Number. Theatre Manager's External Account value (name or number) will be used to create the export file.

- GL Department / Category: An associated Department/Category Code to the Account Number. Theatre Manager's External Account value (name or number) will be used to create the export file.

- Object: The iCity account number. Theatre Manager's External Account value (name or number) will be used to create the export file.

- Amount: The Debit Amount (represented as a positive value) or the Credit Amount (represented as a negative value) of the transaction.

- Description: The Memo Text for this G/L Detail Line.

- (detail export) The Description / Memo for this particular G/L transaction from Theatre Manager's journal entry.

- (summary export) The description will be a combination of the GL Account Description and the summary level category (e.g. Event Code, Fee Description, Donation Campaign, Pass Description, or Resource Description).

- Cost Centre 1: An associated Cost Center ID to the Account Number. Theatre Manager does NOT populate this field during the export process.

- Cost Centre 2: An associated Cost Center ID to the Account Number. Theatre Manager does NOT populate this field during the export process.

- Cost Centre 3: An associated Cost Center ID to the Account Number. Theatre Manager does NOT populate this field during the export process.

The iCity - Summary export creates a summarized version of the deposit and sales postings for each posting date. The deposit and sales postings lines are summarized into a single entry for each posting date within the export file.

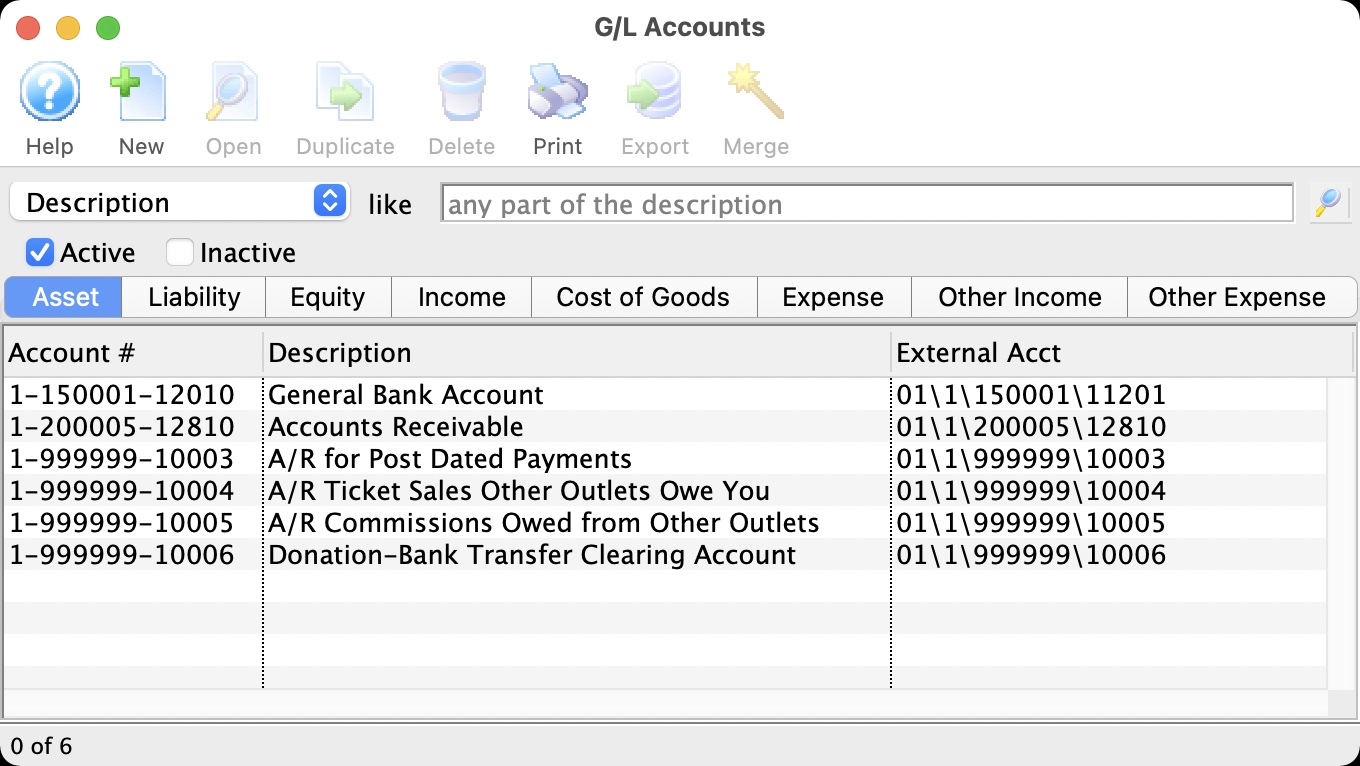

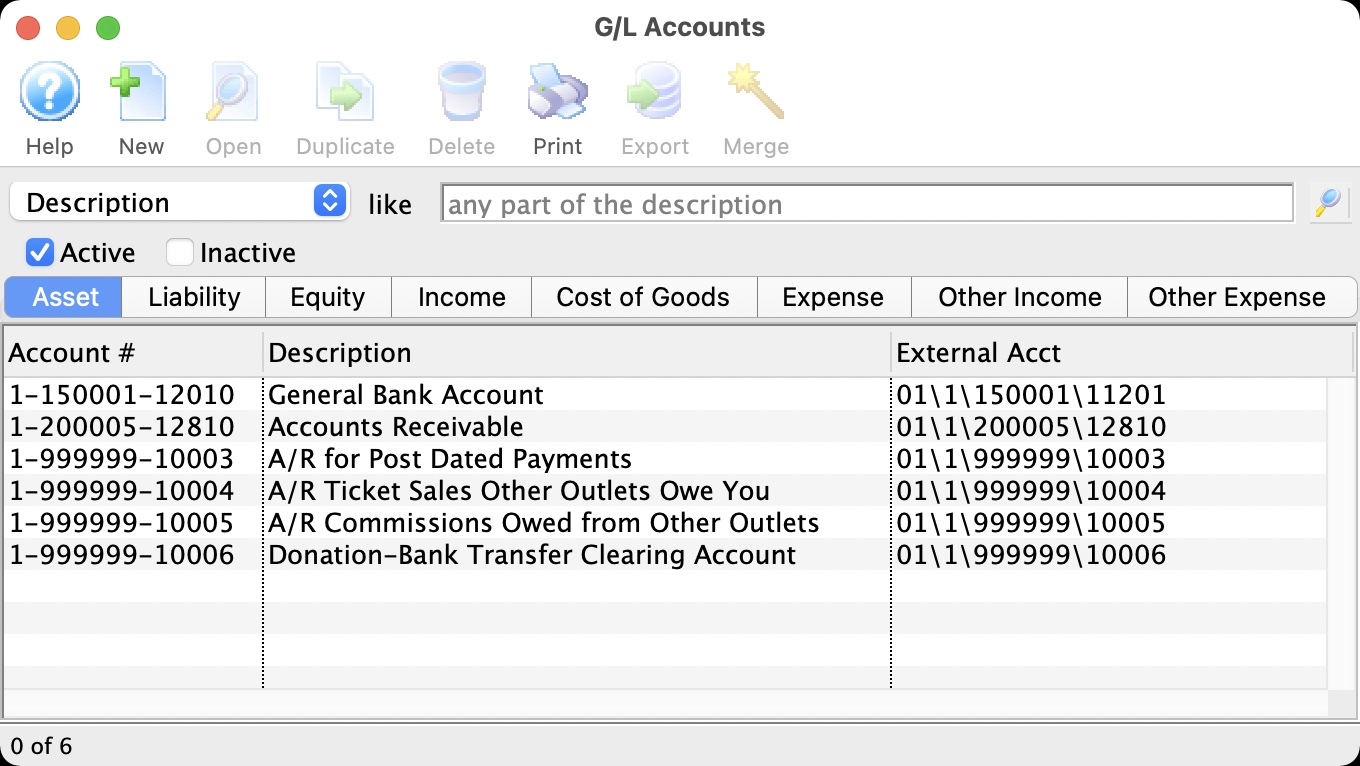

iCity Account Format Top

Theatre Manager's External Account number are required to be set up in a specific format to accommodate the various aspects of the iCity export file:

- Fund:

F01- A predefined Fund ID within iCity. - Class:

C2- A predefined Class ID within iCity. - GL Department / Category:

D710000- A predefined Department / Category ID within iCity. - Object:

A64220- The Account Number that transactions get posted to.

The format of the External Account varies based on the purpose of the GL Account. The format of this field is required to have a backslash (\) used as separator between fields. A leading or trailing backslash for the External Account field should NOT be added:

- (Accounts with No Fund, No Class, No Dept, Object) The field formation will be

\\\A64220 - (Accounts with Fund, No Class. No Dept, Object) The field formation will be

F01\\\A64220 - (Accounts with Fund, No Class, Dept, Object) The field formation will be

F01\\D710000\A64220 - (Accounts with Fund, Class, Dept, Object) The field formation will be

F01\C2\D710000\A64220 - (Accounts with No Fund, No Class, Dept, Object) The field formation will be

\\D710000\A64220 - (Accounts with No Fund, Class, No Dept, Object) The field formation will be

\C2\\A64220

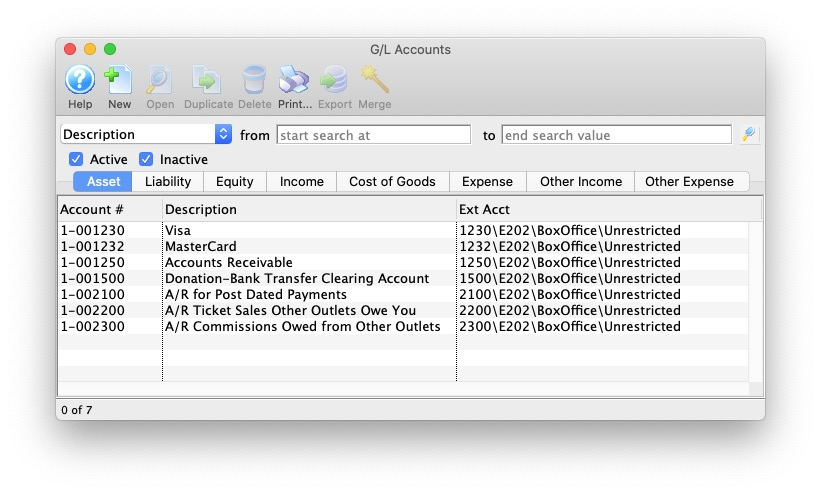

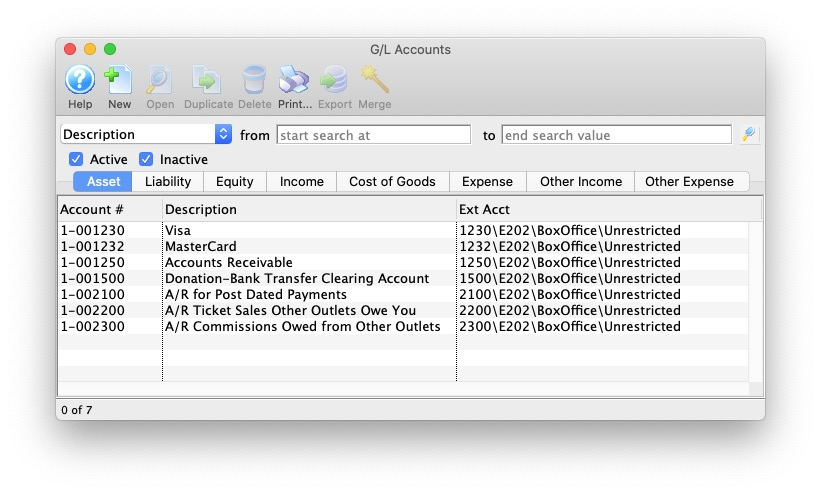

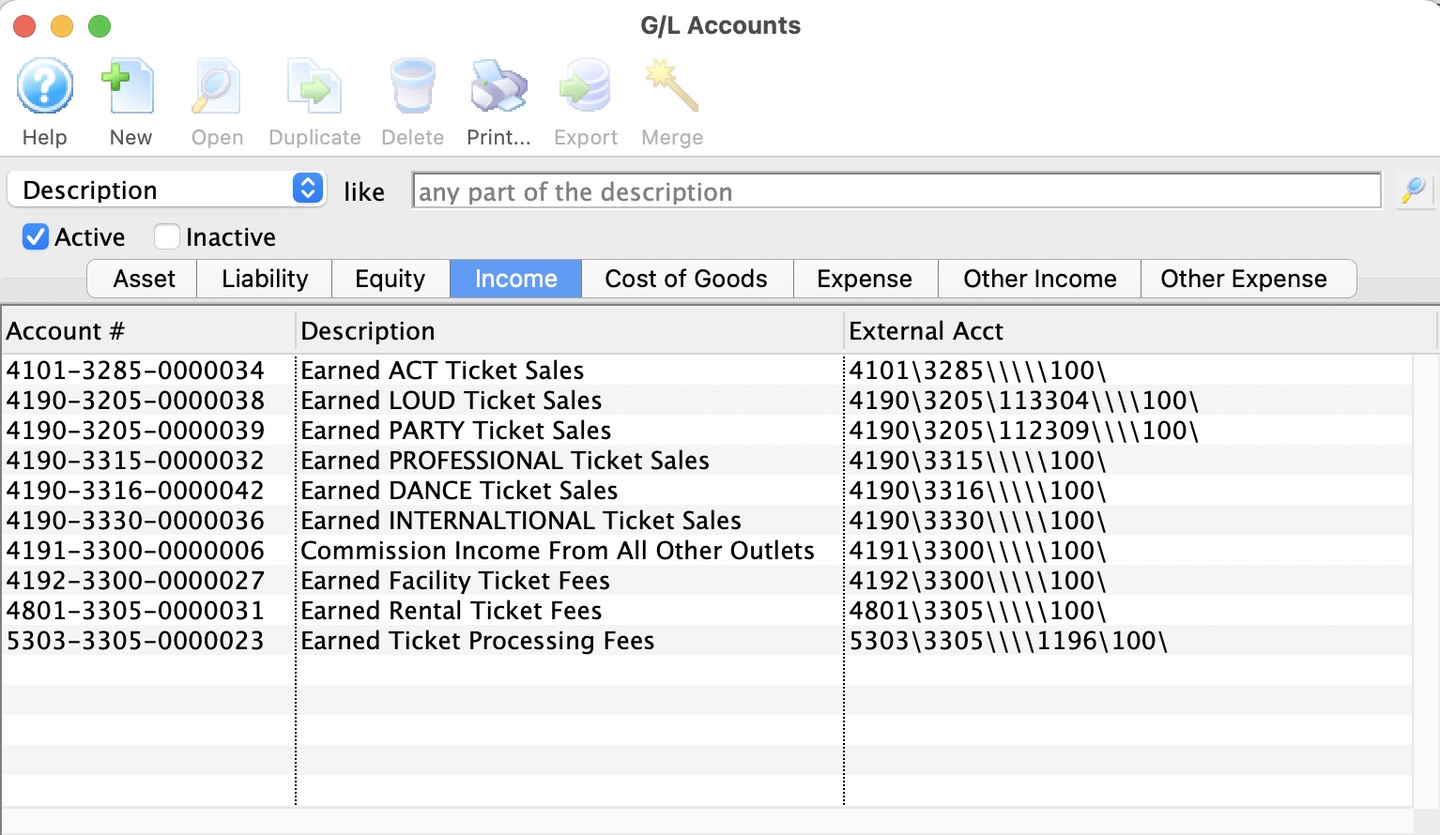

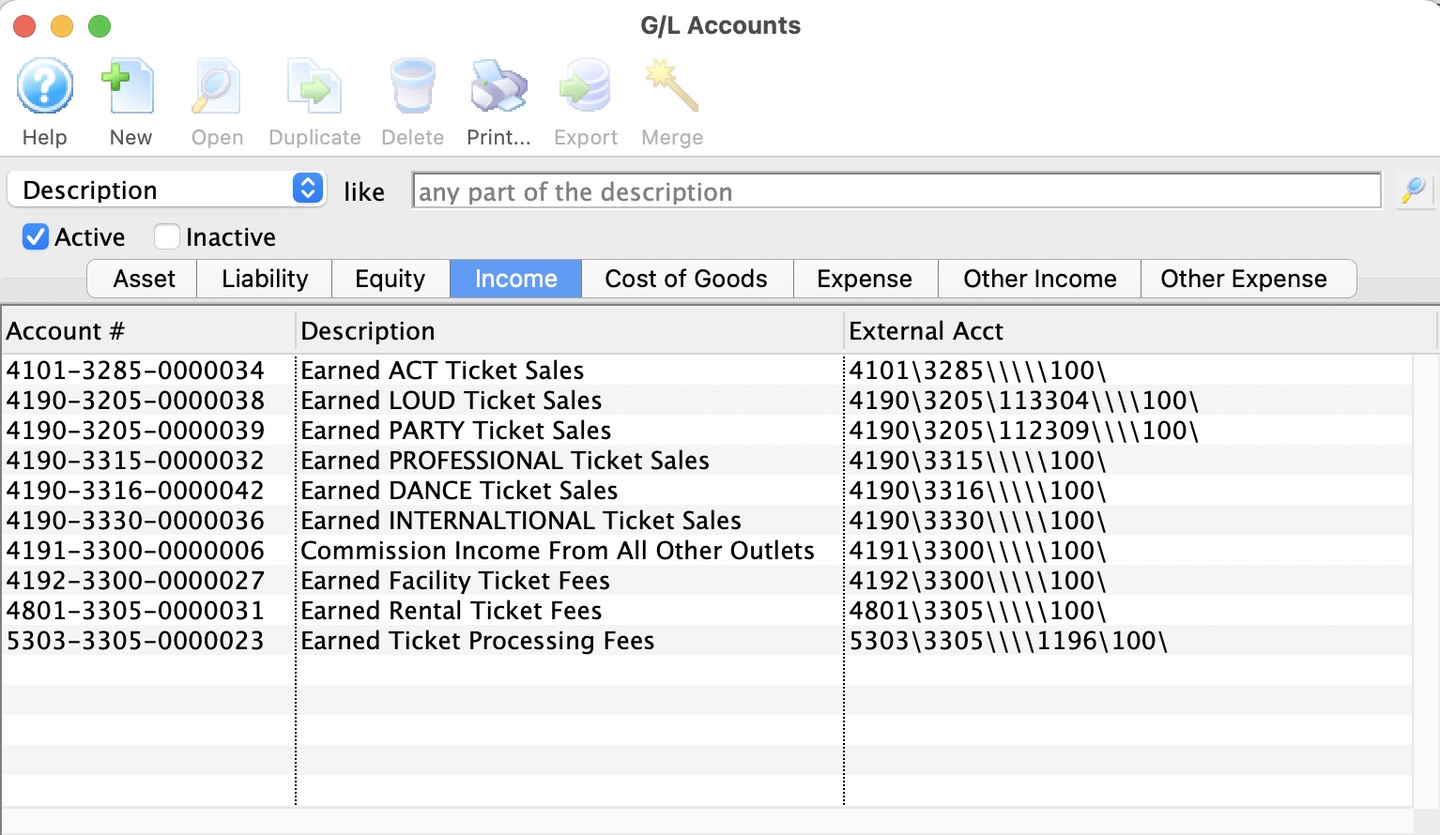

Here's an example of asset account formats.

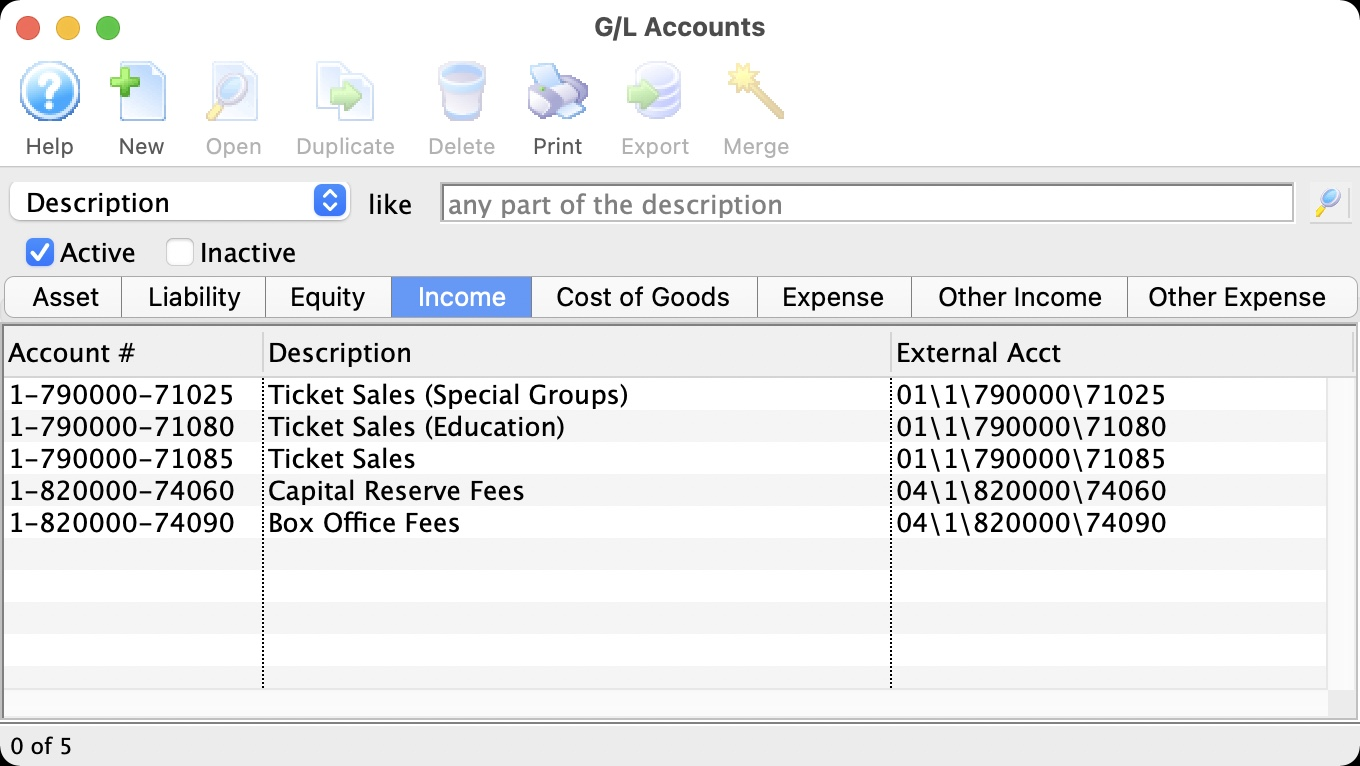

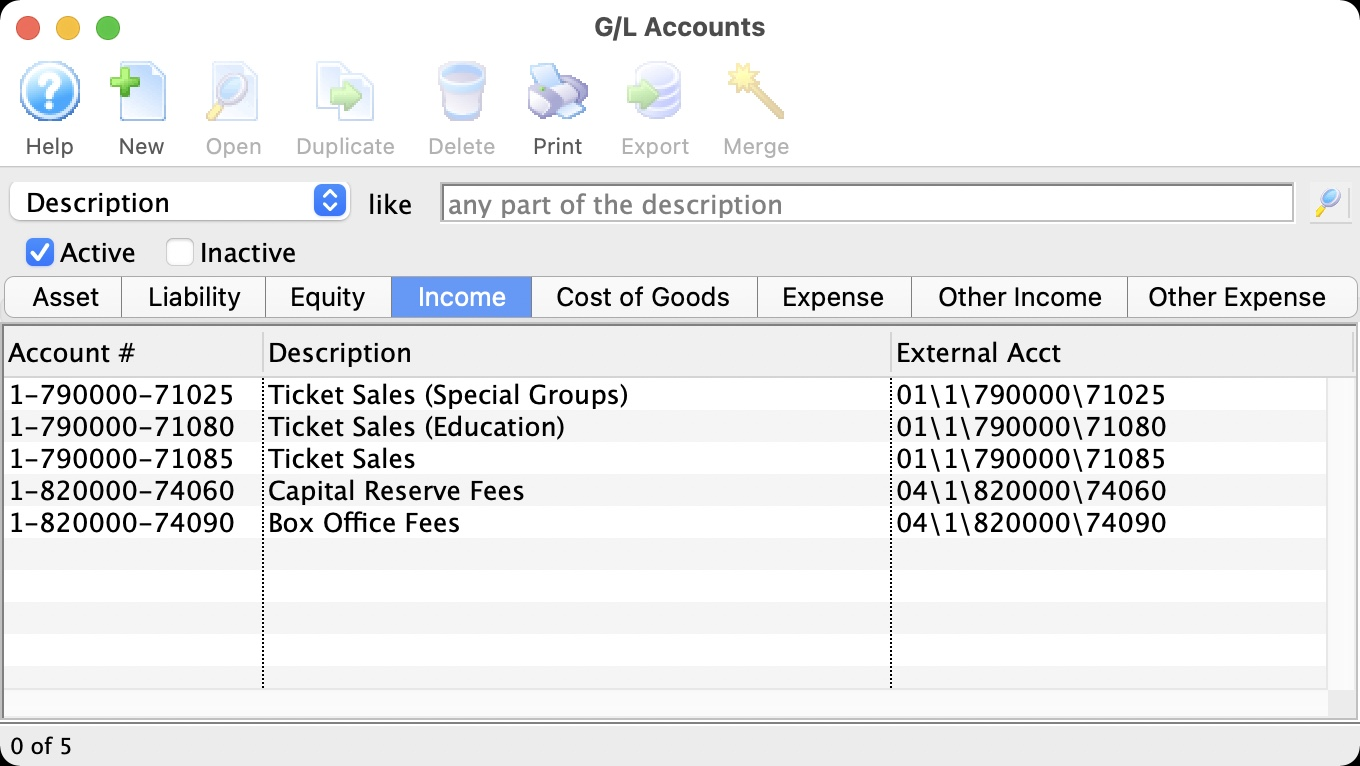

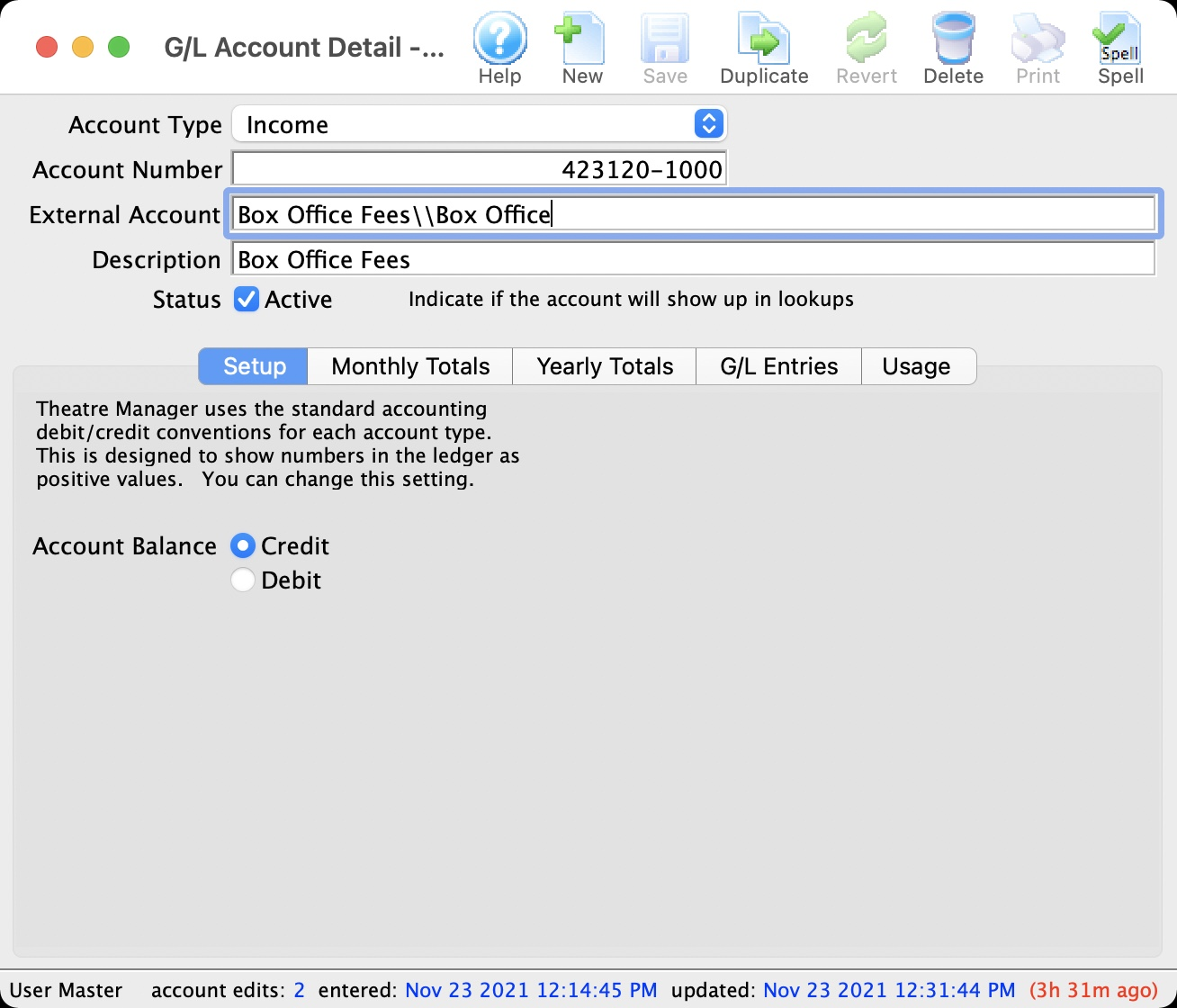

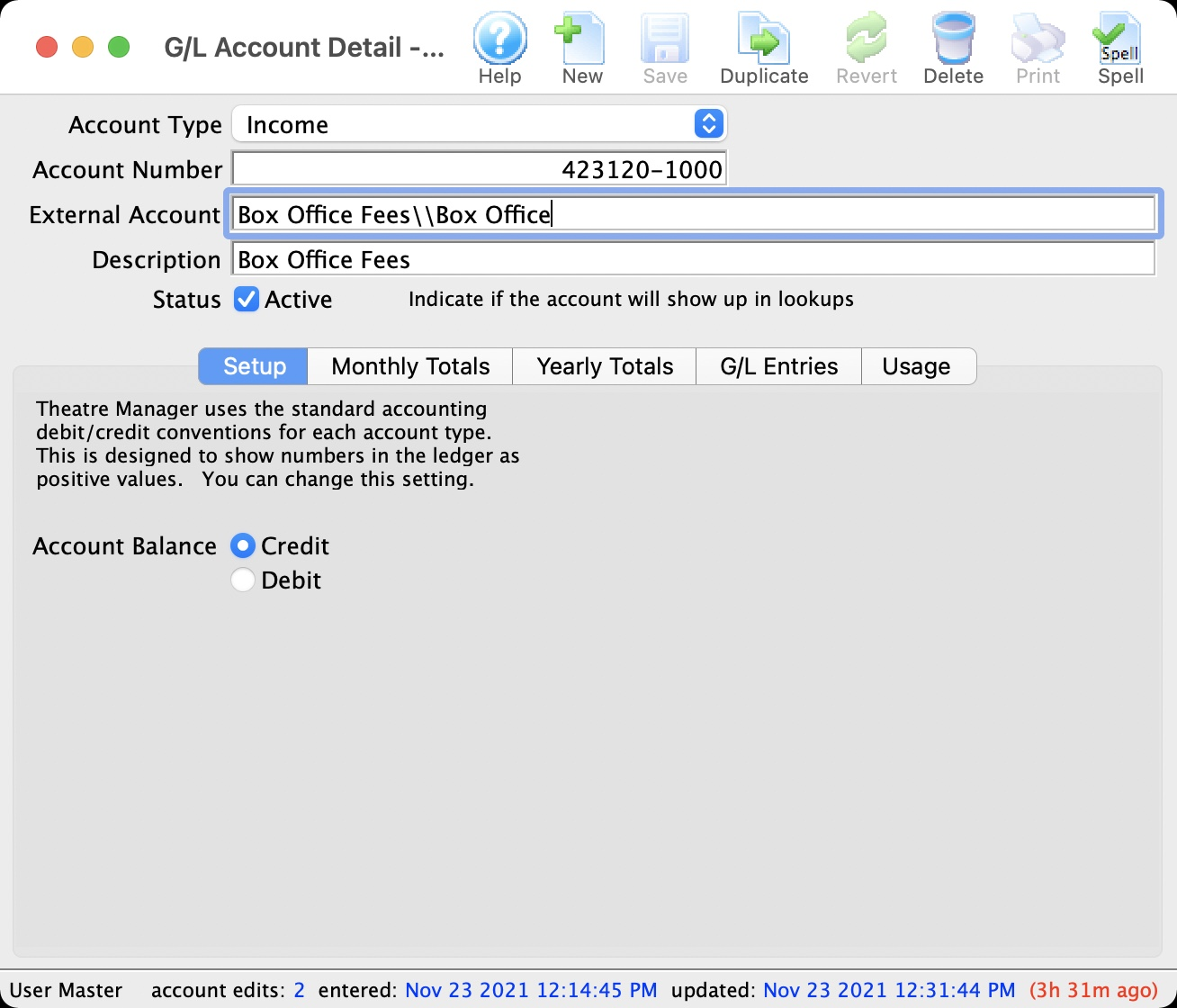

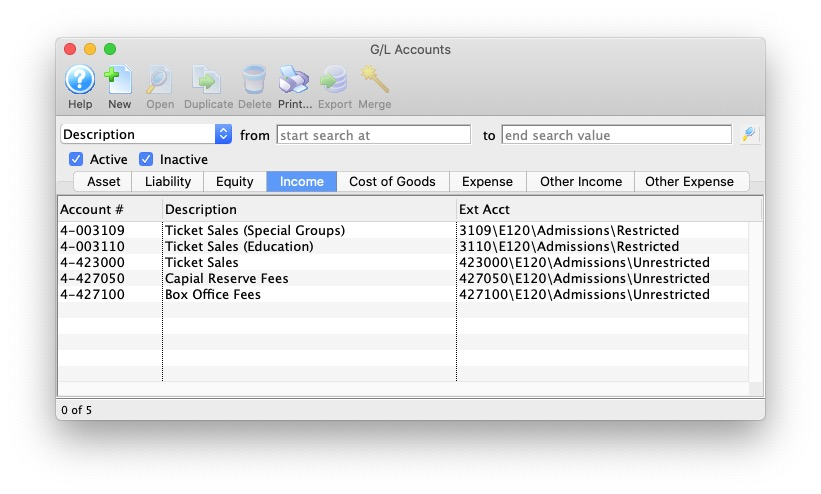

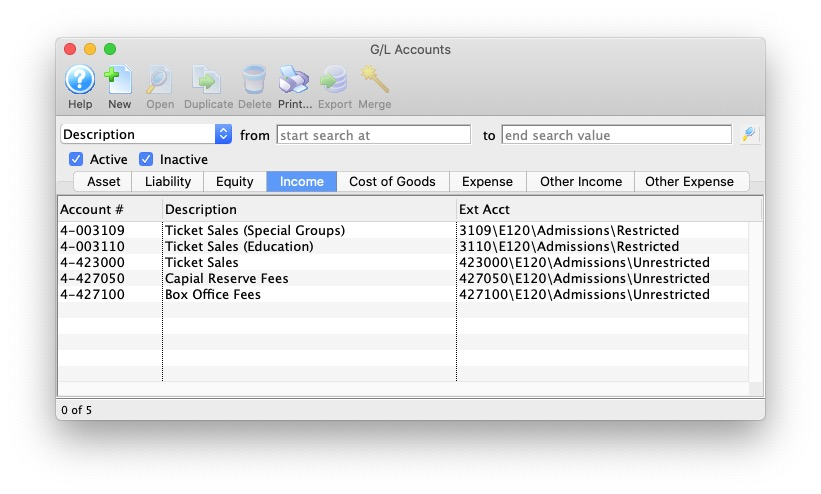

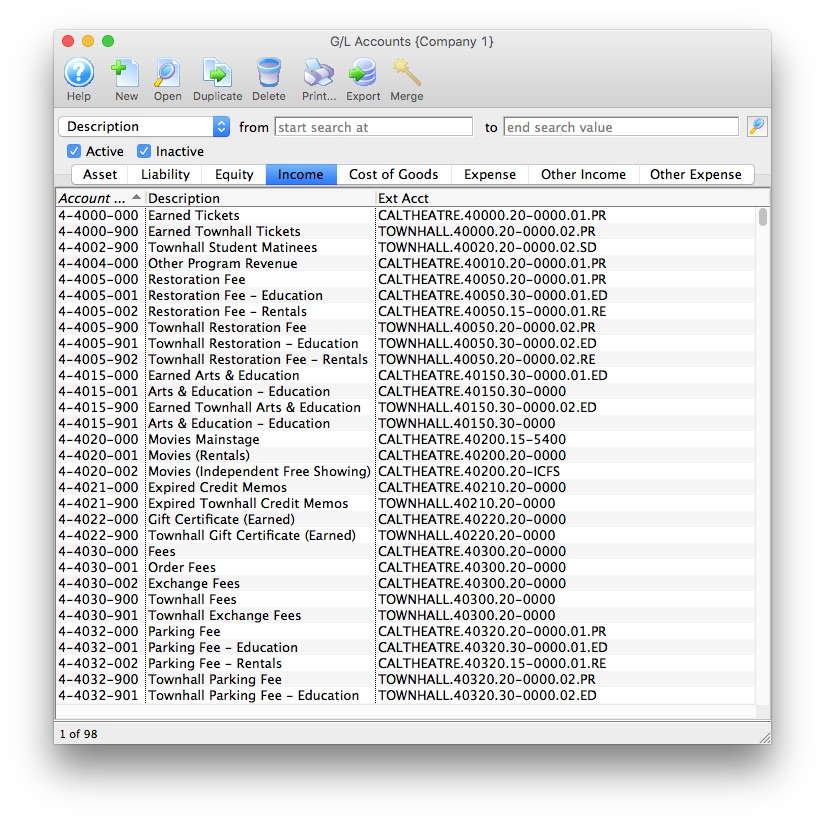

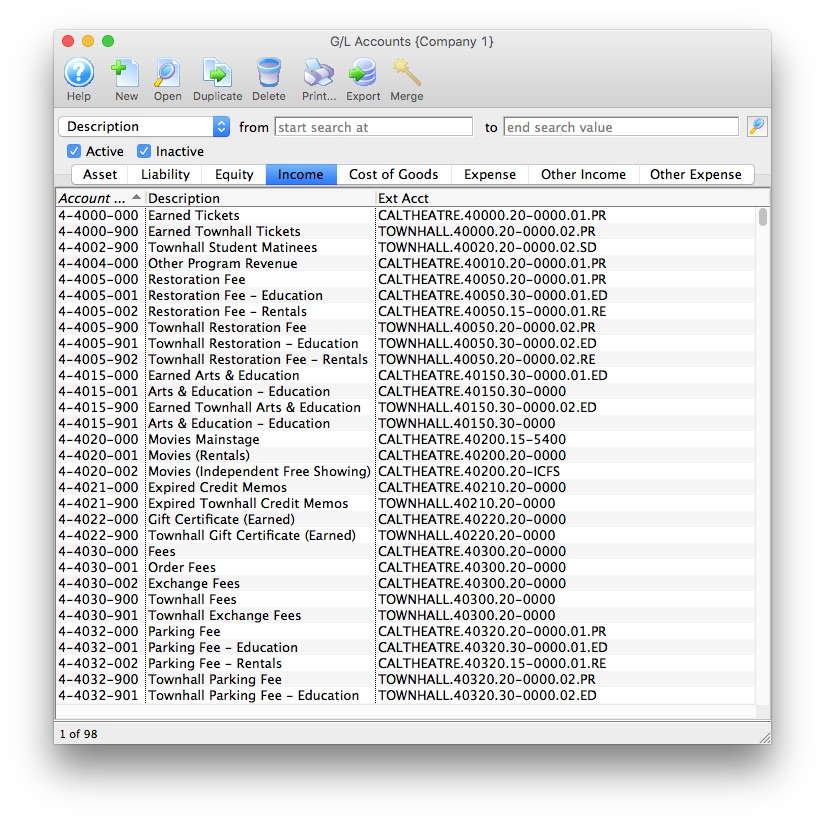

Here's an example of income account formats.

MUNIS Systems G/L Export Format Top

MUNIS Systems, Standard Long Account Format creates a .csv (text file, comma delimited) file that can be directly opened in MUNIS with no need for conversion.

Quickbooks Desktop G/L Export Format Top

See the special field formats you need to have in place in Theatre Manager's External Account Setup prior to performing the first export.

Did You Know?

Quickbooks Desktop is the only version that supports import of IIF files (Intuit Interchange Format). If you would like to use this feature and are using QuickBooks Online, you will need to find a companion importer product from a third party software provider. There are many companion products available for QuickBooks Online that offer file import utilities, such as AaaTeX Corp (IIFImporter and IIFImporter2 for QuickBooks Online).

Did You Know?

For step by step instructions on importing IIF files into QuickBooks, visit the QuickBooks Community at Learning how to import Intuit Interchange Format (.IIF) files into QuickBooks.

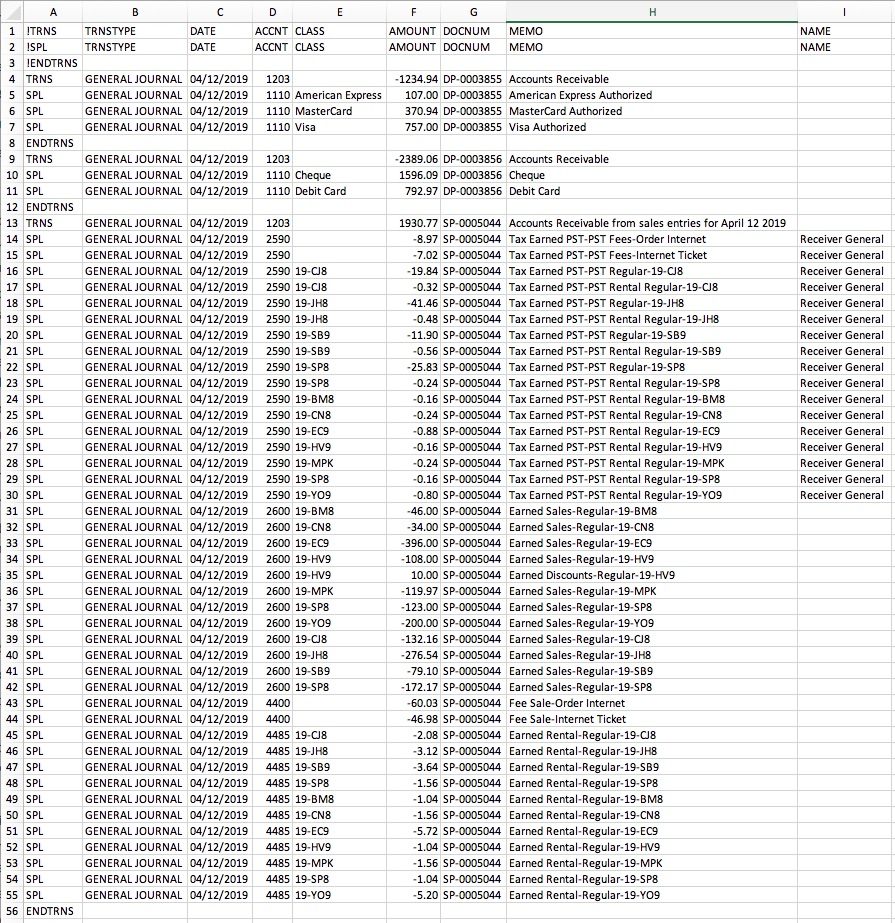

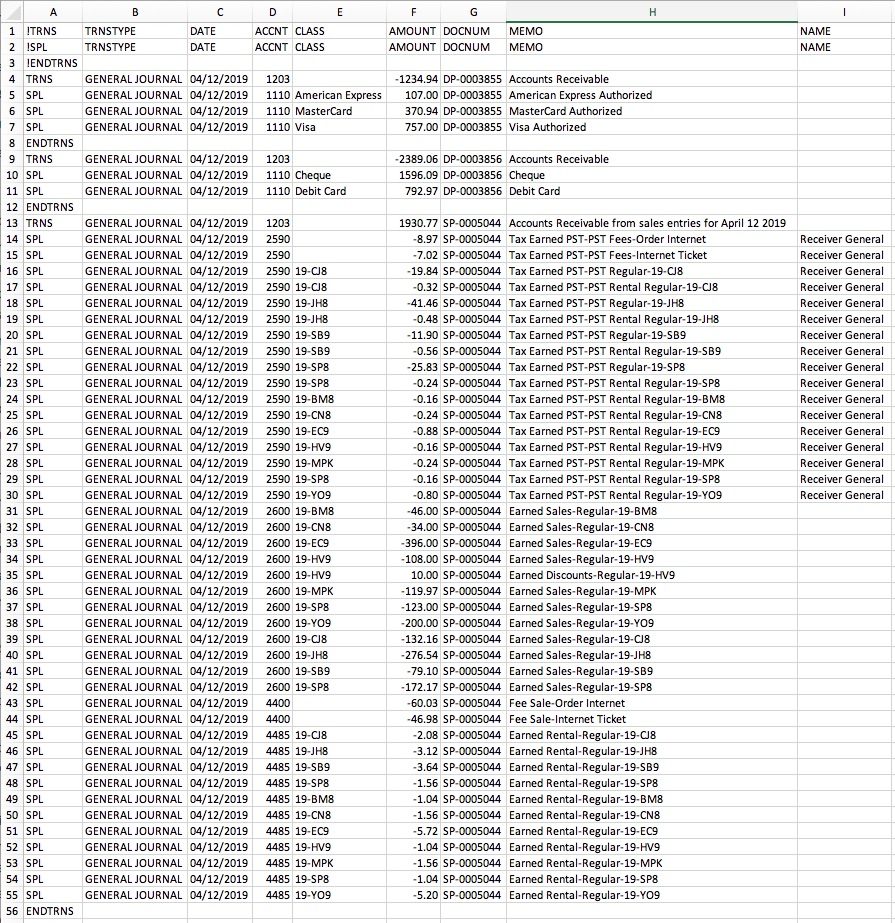

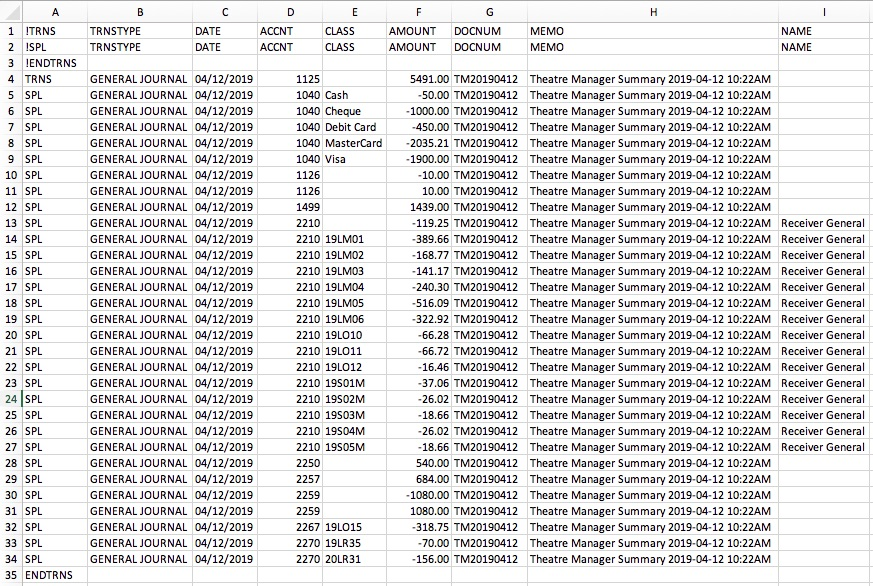

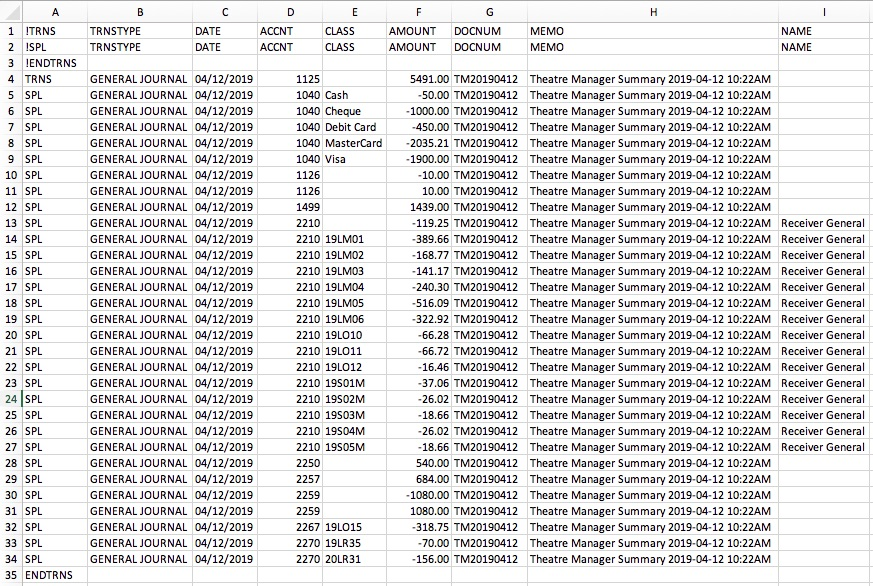

The QuickBooks - Detail exports each detail line within the G/L Entry. Each deposit and sales posting are exported as their own separate entries within the export file. This allows an exact match of each G/L entry to crossover into QuickBooks (line for line).

The QuickBooks - Summary export creates a summarized version of the deposit and sales postings for each posting date. The deposit and sales postings lines are summarized into a single entry for each posting date within the export file.

Parts of the QuickBooks Export File:

- TRNS: The keyword for a transaction.

- TRNS identifies the start of a new transaction.

- SPL identifies each distribution line within a transaction.

- ENDTRNS identifies the end of the existing transaction.

- TRNSTYPE: A keyword that identifies the type of transaction.

- (2007-2018 export) It will default to Journal for General Journal transactions.

- (2019 and later export) It will default to General Journal for General Journal transactions.

- DATE:

- (detail export) The Journal Entry Date. The date is always in MM/DD/YYYY format.

- (summary export) The Journal Posting Date. The date is always in MM/DD/YYYY format.

- ACCNT: The name or account number of the QuickBook's account. Theatre Manager's External Account value (name or number) will be used to create the export file.

- QuickBooks is able to match on either Account Name or Account Number. Theatre Manager will place in the export file the contents of the External Account field.

- If the QuickBooks account cannot be found, QuickBooks will automatically create the account during the import process.

- CLASS: The name of the class that applies to the transaction.

- (ticket sales) The value will default to the Event Code.

- (payments) The value will default to the Payment Method description as its defined in the Code Tables >> Payment Methods.

- AMOUNT: The amount of the transaction. Debit amounts are always positive, credit amounts are always negative.

- DOCNUM: The Journal Entry Reference Number.

- (detail export) The Journal Number from the sales posting or deposit posting (e.g.

SP-0005044,DP-0003855) - (summary export) The combination of TM+yyyy+mm+dd based on the Journal Posting Date plus an extension of E+mm+dd+hh+mm+ss based on the E for exported and the exported date/time. For example, if the Journal Posting Date was April 18, 2019 and the exported date was April 19, 2019 at 10:42:25am, the DOCNUM would be

TM20190418-E0419104225.

- (detail export) The Journal Number from the sales posting or deposit posting (e.g.

- MEMO: The memo text associated with the transaction.

- (detail export) The description or memo for this particular G/L transaction from Theatre Manager's journal entry.

- (summary export) The description will identify the Journal Posting Date.

- NAME: The name of the Agency Vendor.

- If QuickBook's has setup Vendor Name as a Sales Tax Agency for an account (e.g. tax collected account), the vendor name must be provided exactly as it was named in QuickBooks, otherwise QuickBooks will reject the import file.

Quickbooks Field Formats Top

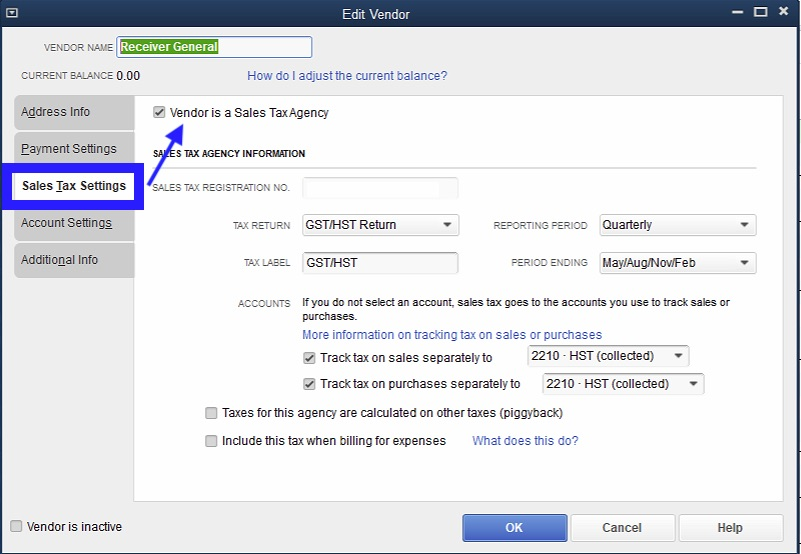

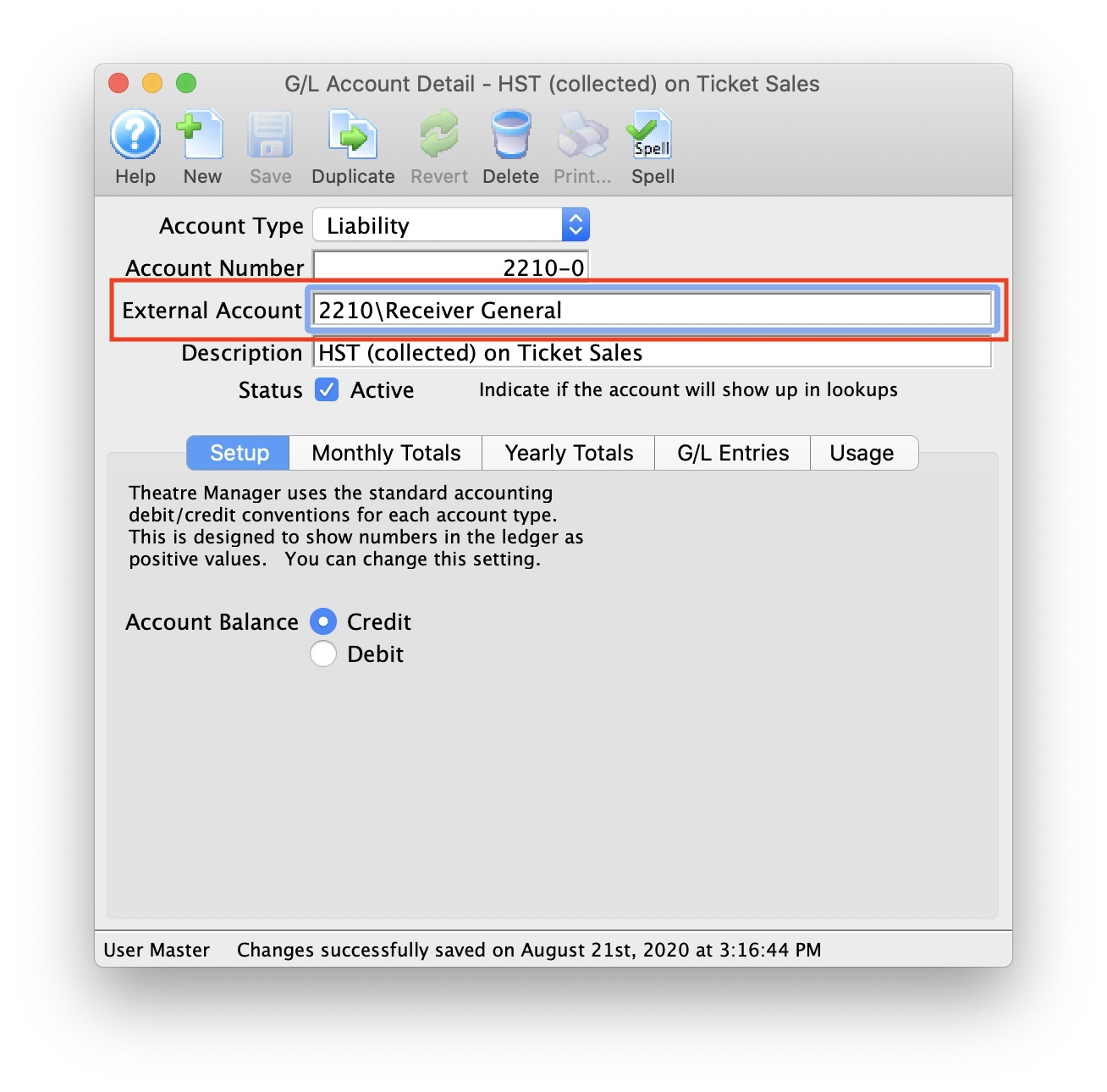

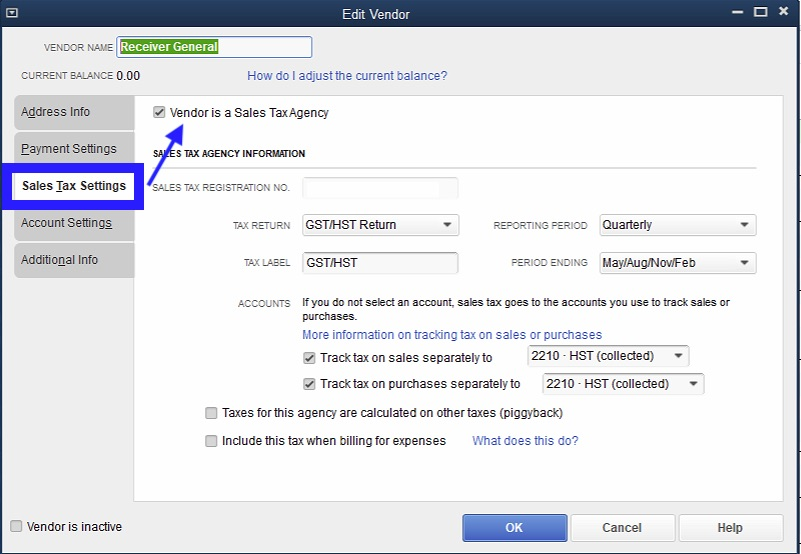

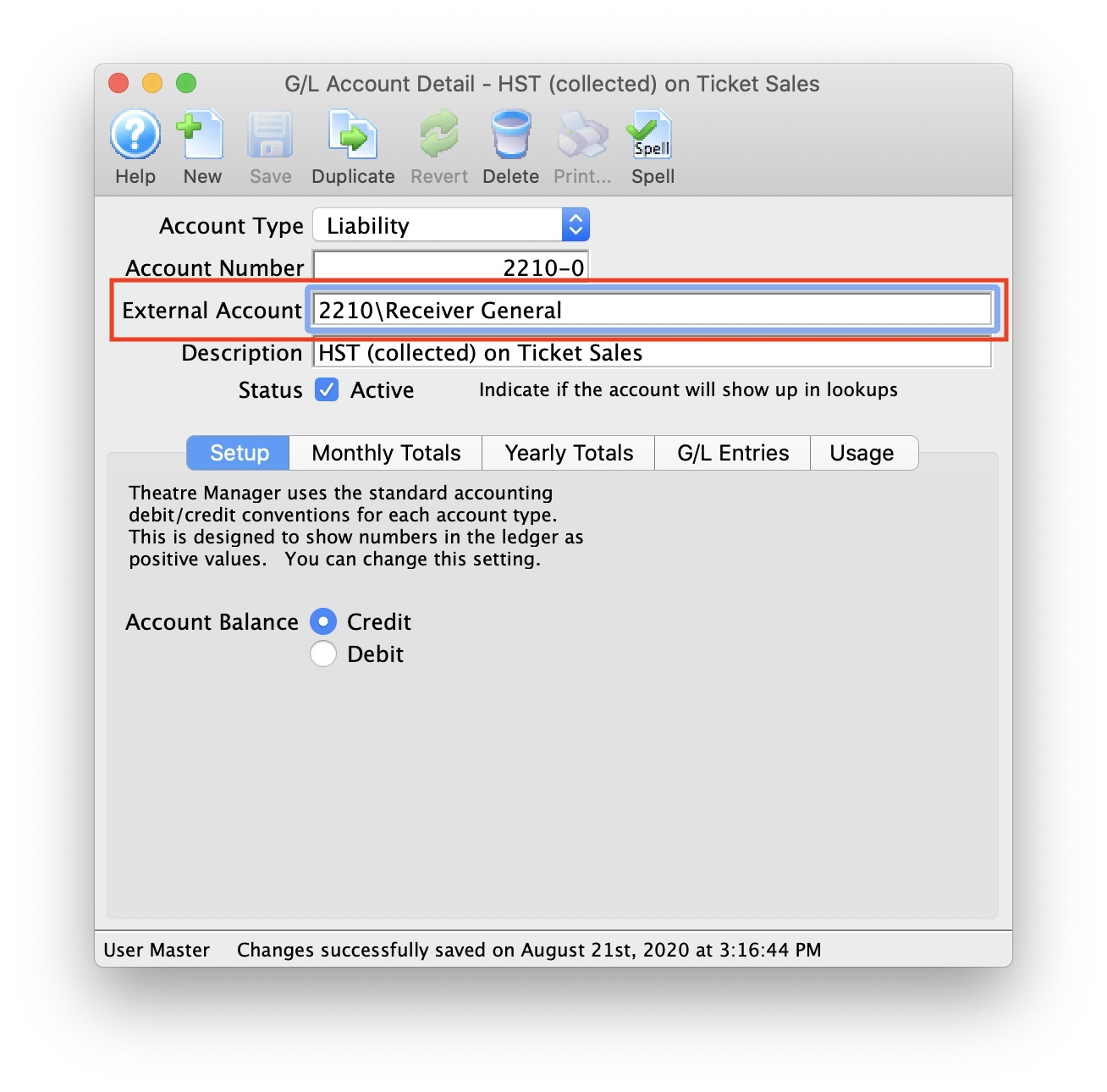

In QuickBooks, you may have set a Vendor as a Sales Tax Agency for your tax account(s).

If QuickBooks is set up in this manner, this example illustrates how to set up the External Account description. It must be set as [AccountNameOrNumber][VendorName] where a backslash (\) separates the 2 fields. During the export process, the External Account field will be automatically parsed into the 2 separate values for ACCNT and NAME when a backslash is within the External Account field.

Common Quickbook Format Errors Top

QB IIF: TRNSTYPE

If you receive this error during the QuickBook's import process, it means you have set Theatre Manager to use the incorrect QuickBook version that you are using. The TRNSTYPE is a keyword that identifies the type of transaction. The solution is to alter the QuickBook's Export version in the Account Export Formats to use the correct version: * (2007-2018 export) It will default to Journal for General Journal transactions. * (2019 and later export) It will default to General Journal for General Journal transactions.

The customer job field cannot be blank. From the drop-down list, choose a customer or job, or enter a new name.

QuickBooks has a requirement that a valid Customer/Vendor is included when posting to the built-in accounts receivable or payable accounts. QuickBooks cannot assign a receivable or a payable to 'nobody', so it requires a Customer/Vender that is previously setup within QuickBooks.

The solution is as simple as avoiding any postings directly to the QuickBooks account types of Accounts Receivable and Accounts Payable. Rather:

* Create a separate standard (non A/R) asset account

* Call it (for example) A/R for Theatre Manager

* Separate liability account and call it (for example) A/P for Theatre Manager

* Reference those account numbers in Theatre Manager's External Account value (name or number) used to create the export file.

This way, there is no need to maintain Customers/Payees/Vendors in the export file as these accounts are just standard Asset / Liability and not linked to a special account type. Then when you import the amount into QuickBooks, it will go against the standard asset account and not against the built-in accounts receivable account in QuickBooks. When you want to see the details that make up the A/R for Theatre Manager or the A/P for Theatre Manager account is, go directly to Theatre Manager for the details, rather than QuickBooks.

To recap, create a standard Asset & and a standard Liability account to use to post to in QuickBooks.

Quickbooks Online G/L Export Format Top

Did You Know?

For step-by-step instructions on importing CSV or Excel files into QuickBooks, visit QuickBooks Support at Import Journal Entries in QuickBooks Online.

See the special field formats you need to have in place in Theatre Manager's External Account Setup prior to performing the first export.

The QuickBooks - Detail exports each detail line within the G/L Entry. Each deposit and sales posting are exported as their own separate entries within the export file. This allows an exact match of each G/L entry to crossover into QuickBooks (line for line).

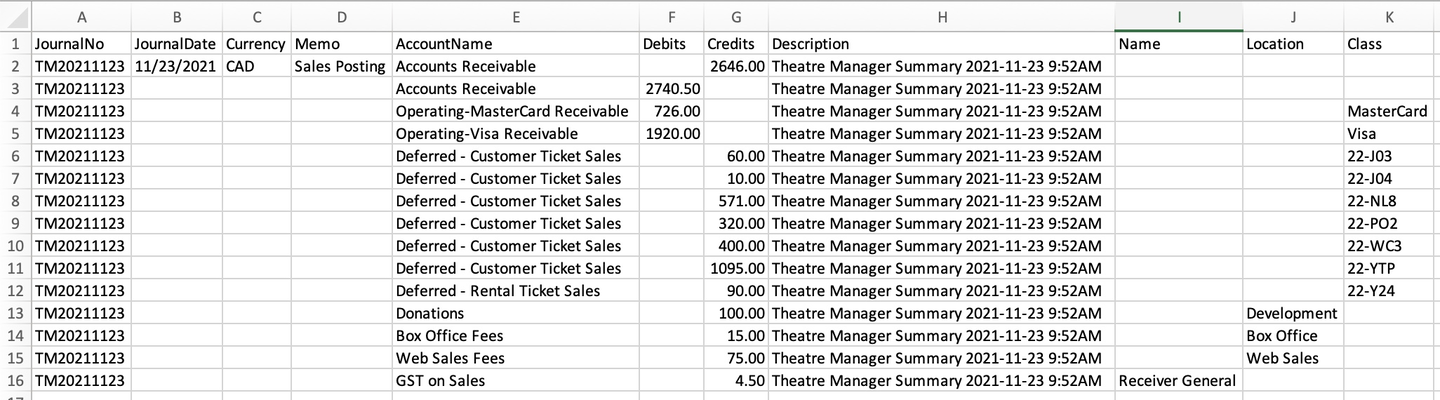

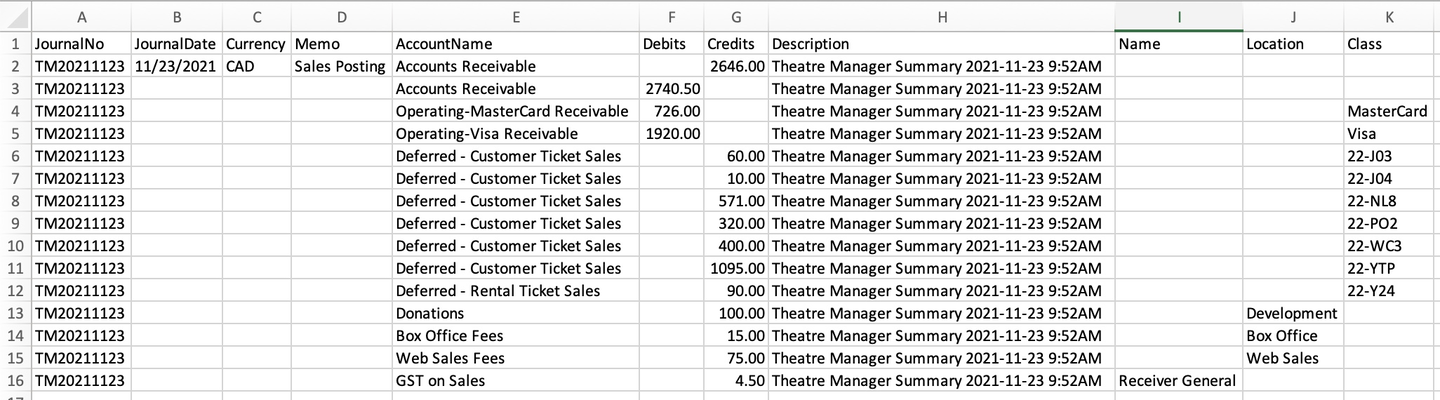

The QuickBooks - Summary export creates a summarized version of the deposit and sales postings for each posting date. The deposit and sales postings lines are summarized into a single entry for each posting date within the export file.

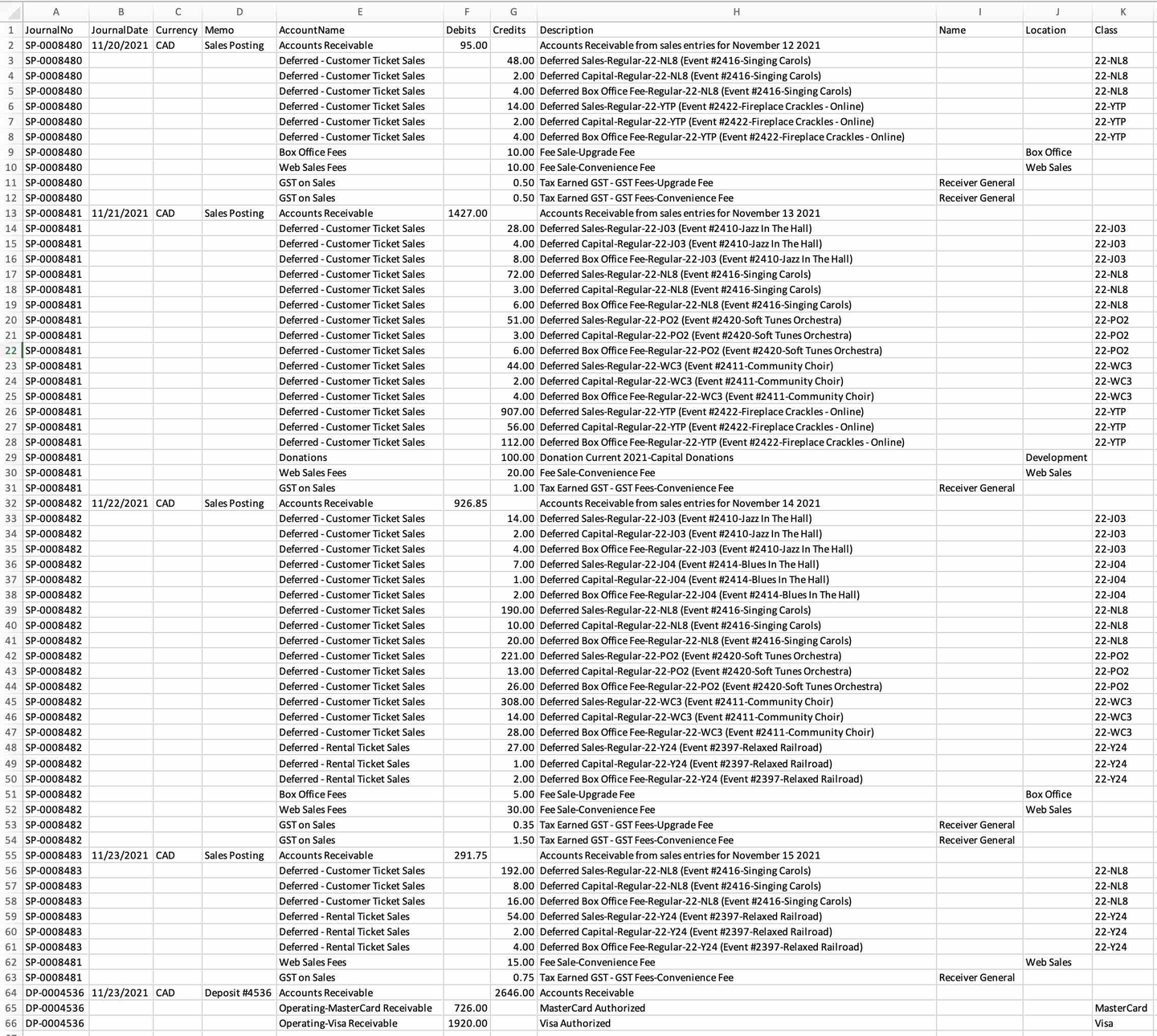

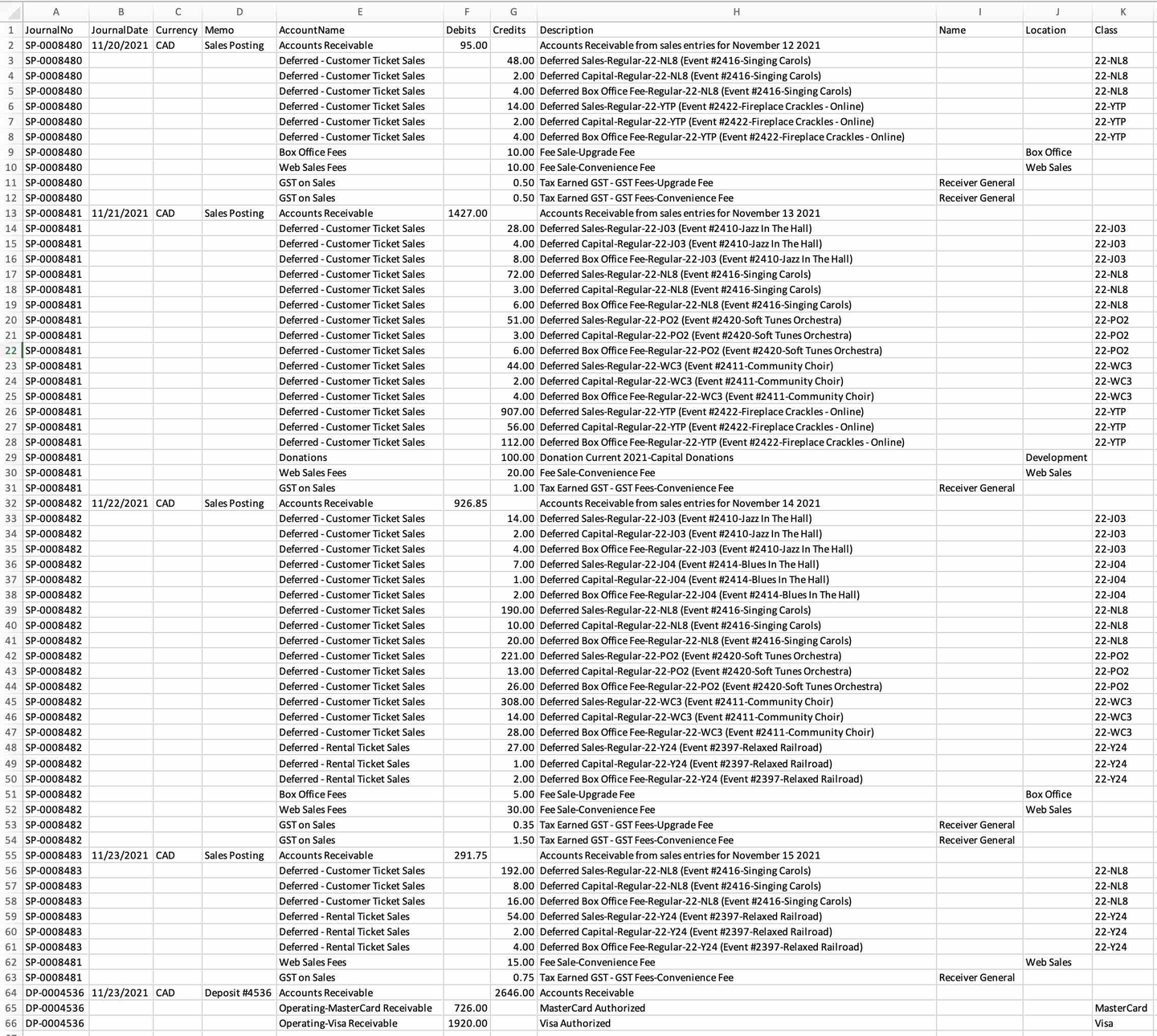

Parts of the QuickBooks Export File:

- JournalNo: Journal Entry Reference Number.

- (detail export) The Journal Number from the sales posting or deposit posting (e.g.

SP-0008480,DP-0004536) - (summary export) The combination of TM+yyyy+mm+dd based on the Journal Posting Date plus an extension of E+mm+dd+hh+mm+ss based on the E for exported and the exported date/time. For example, if the Journal Posting Date was November 23, 2021 and the exported date was November 24, 2021 at 10:42:25am, the JournalNo would be

TM20211123-E1124104225.

- (detail export) The Journal Number from the sales posting or deposit posting (e.g.

- JournalDate:

- (detail export) The Journal Entry Date. The date is always in MM/DD/YYYY format.

- (summary export) The Journal Posting Date. The date is always in MM/DD/YYYY format.

- Currency: A valid Currency Code. Required for multi-currency databases. Default Values are

CADorUSD. - Memo: The Journal Entry Description for this G/L Entry (e.g.

Sales Posting,Deposit Posting). - AccountName: The name or account number of the QuickBook's account. Theatre Manager's External Account value (name or number) will be used to create the export file.

- QuickBooks is able to match on either Account Name or Account Number. Theatre Manager will place in the export file the contents of the External Account field.

- QuickBooks requires all new accounts to be created before importing. Be sure to add them in your chart of accounts.

- Debits: The Debit Amount of the transaction.

- Credits: The Credit Amount of the transaction.

- Description: The memo text associated with the transaction.

- (detail export) The description or memo for this particular G/L transaction from Theatre Manager's journal entry.

- (summary export) The description will identify the Journal Posting Date.

- Name: The name of the Agency Vendor.

- If QuickBooks has set Vendor Name as a Sales Tax Agency for an account (e.g. tax collected account), the vendor name must be provided exactly as it was named in QuickBooks, otherwise QuickBooks will reject the import file.

- Location: The location of the transaction.

- You can customize sales forms by location to make it easier to track sales by a specific site. Refer to QuickBooks Support to Turn on Location Tracking. For each transaction, you can assign 1 location only.

- When providing a Location with transaction, the Location must be provided exactly as it was named in QuickBooks, otherwise QuickBooks will reject the import file.

- Class: The name of the class that applies to the transaction.

- (ticket sales) The value will default to the Event Code.

- (payments) The value will default to the Payment Method description as its defined in the Code Tables >> Payment Methods.

- Classes represent meaningful parts of your company, like store departments or product lines. You can use them to get deeper insights into your sales, expenses, or profitability for each part of your business. Refer to QuickBooks Support to Turn on Class Tracking. For each transaction, you can assign 1 class only.

- When providing a Class with transaction, the Class must be provided exactly as it was named in QuickBooks, otherwise QuickBooks will reject the import file.

Quickbooks Online Field Formats Top

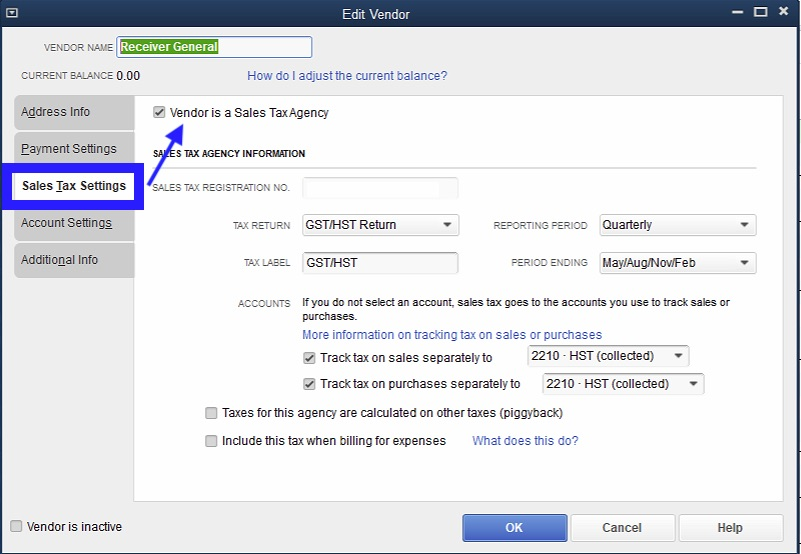

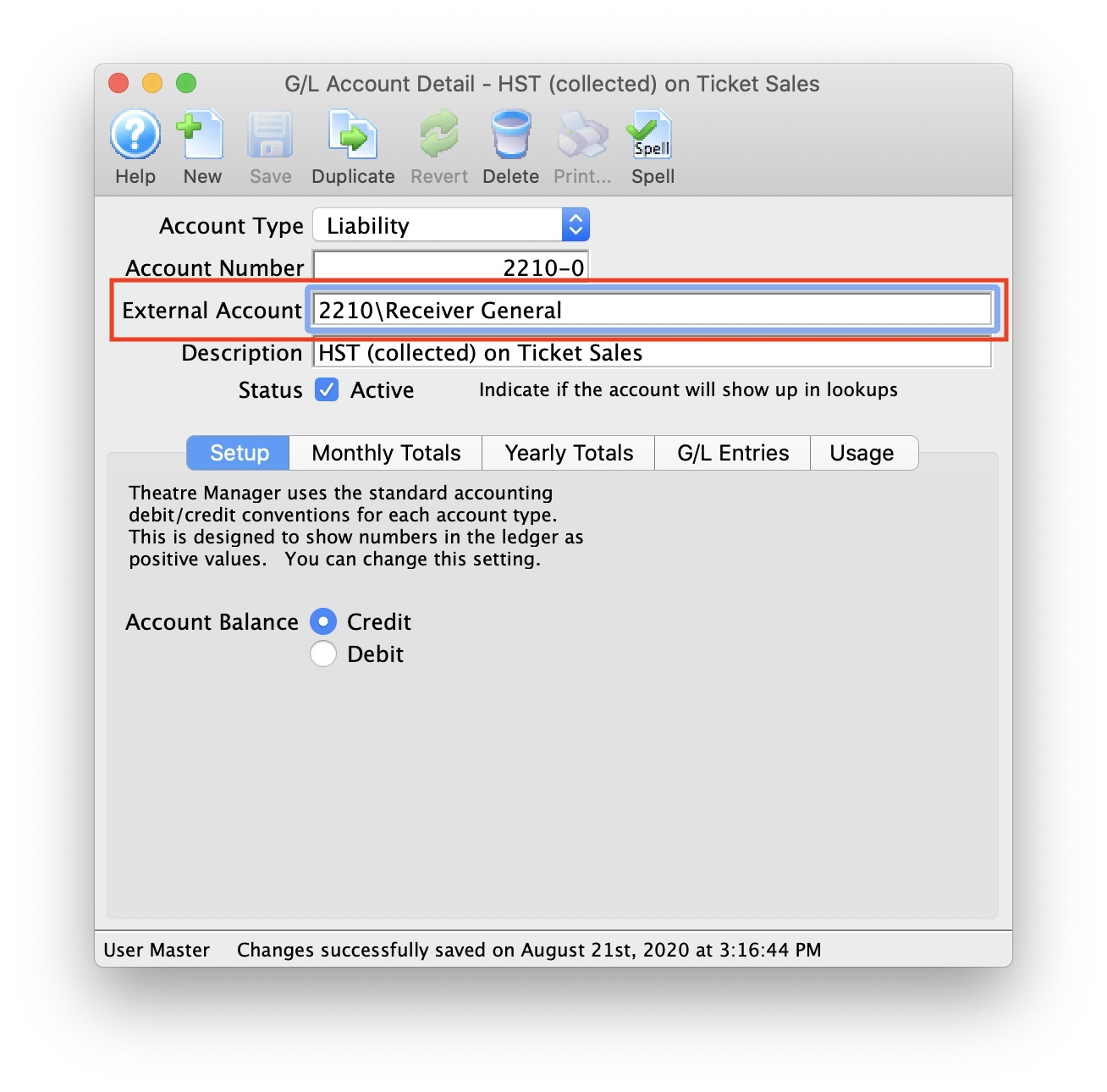

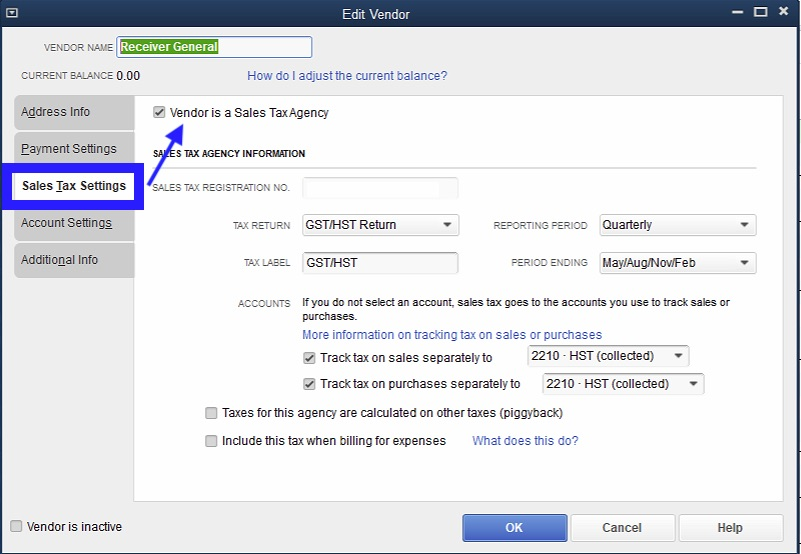

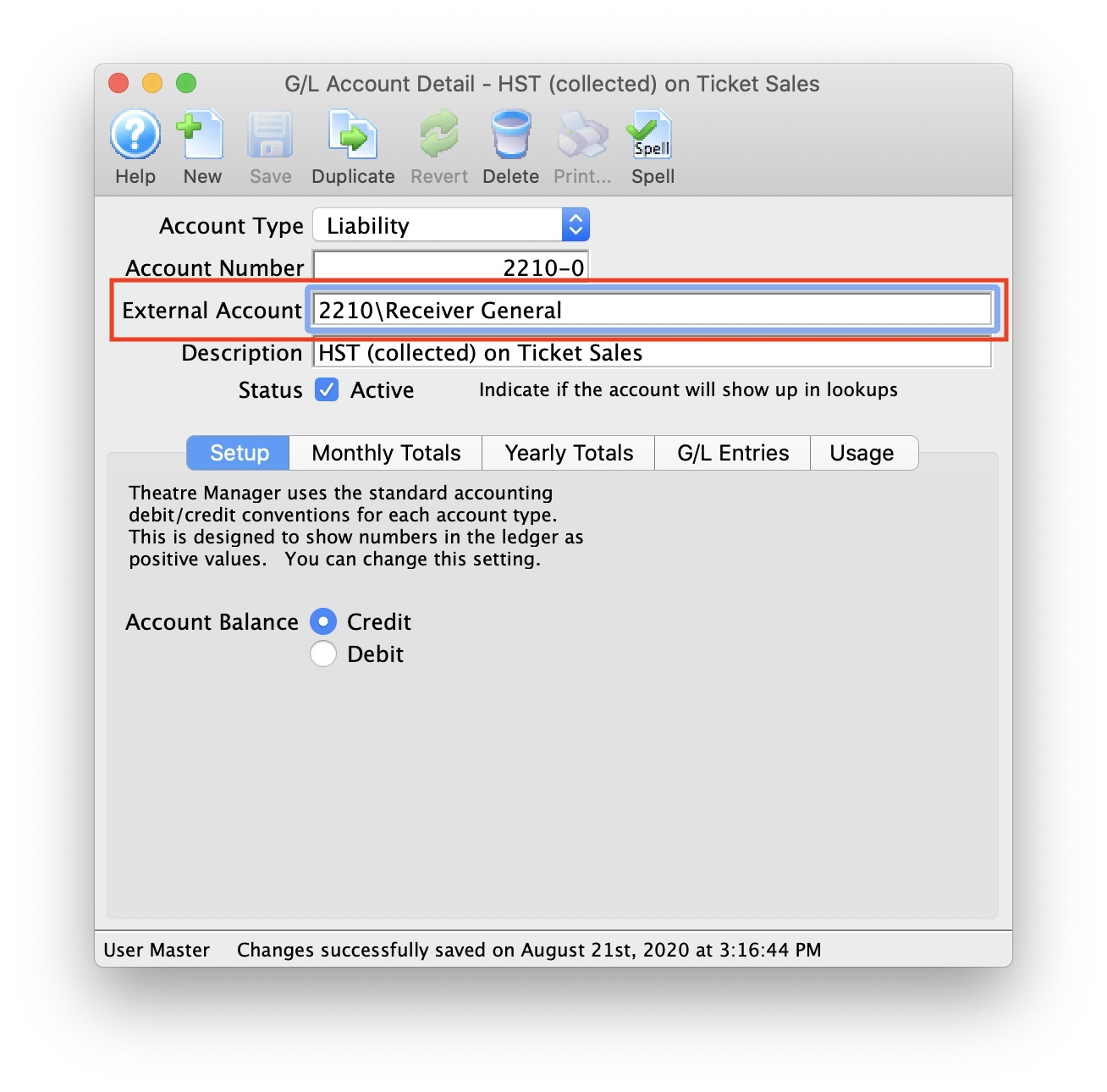

In QuickBooks, you may have set a Vendor as a Sales Tax Agency for your tax account(s).

If QuickBooks is set up in this manner, the following example illustrates how to set up the External Account description. It must be set as [AccountNameOrNumber][VendorName][Location] where a backslash separates the 3 fields.

In QuickBooks, you may have enabled Location tracking. If QuickBooks is set up in this manner, this example illustrates how to set up the External Account description. It must be set as [AccountNameOrNumber][VendorName][Location] where a backslash separates the 3 fields. During the export process, the External Account field will be automatically parsed into the 3 separate values for AccountName, Name, and Location when a backslash is within the External Account field.

Common Quickbooks Online Errors Top

The customer job field cannot be blank. From the drop-down list, choose a customer or job, or enter a new name.

QuickBooks has a requirement that a valid Customer/Vendor is included when posting to the built-in accounts receivable or payable accounts. QuickBooks cannot assign a receivable or a payable to 'nobody', so it requires a Customer/Vender that is previously setup within QuickBooks.

The solution is as simple as avoiding any postings directly to the QuickBooks account types of Accounts Receivable and Accounts Payable. Rather:

* Create a separate standard (non A/R) asset account

* Call it (for example) A/R for Theatre Manager

* Separate liability account and call it (for example) A/P for Theatre Manager

* Reference those account numbers in Theatre Manager's External Account value (name or number) used to create the export file.

This way, there is no need to maintain Customers/Payees/Vendors in the export file as these accounts are just standard Asset / Liability and not linked to a special account type. Then when you import the amount into QuickBooks, it will go against the standard asset account and not against the built-in accounts receivable account in QuickBooks. When you want to see the details that make up the A/R for Theatre Manager or the A/P for Theatre Manager account is, go directly to Theatre Manager for the details, rather than QuickBooks.

To recap, create a standard Asset & and a standard Liability account to use to post to in QuickBooks.

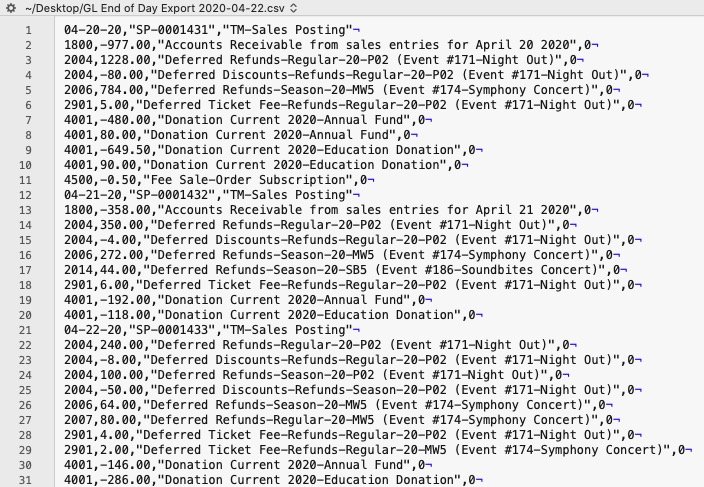

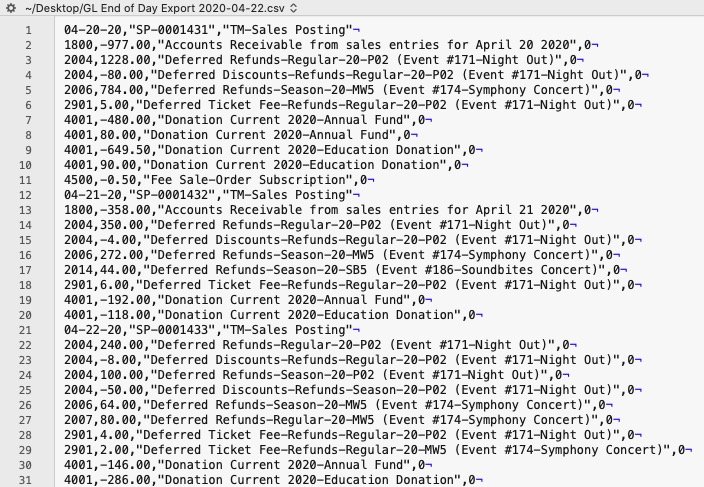

Sage 50 G/L Export Format Top

The Sage 50 Accounting Software exports each detail line within the G/L Entry. Each deposit and sales posting are exported as their own separate entry within the export file. This allows an exact match of each G/L Entry to crossover into Sage 50 Accounting (line for line).

Parts of the Sage 50 Export File - Header Record

- Date: The Journal Entry Date, always in MM-DD-YY format.

- Source: Journal Entry Reference Number. The Journal Number from the sales posting or deposit posting will be exported. The field is limited to 13 characters.

- Comment: Journal Entry Description. The combination of TM+Journal Entry Description from the sales posting or deposit posting will be exported. For example, if the Journal Description was

Sales Posting, the Comment would beTM-Sales Posting. The field is limited to 39 characters.

Parts of the Sage 50 Export File - Detail Record

- Account Number: Theatere Manager's External Account value (name or number) will be used to create the export file.

- Amount: The debit amount (represented as a positive value) or the credit amount (represented as a negative value) of the transaction.

- Comment: The memo text associated to this particular G/L transaction from Theatre Manager's journal entry. The field is limited to 160 characters.

- Project Allocation: The number of project allocation lines that follow this G/L Account transaction. The value will default to

0as Theatre Manager will not be allocating the Amount for each Account Number.

Sage Accpac G/L Export Format Top

Sage ACCPAC Version 5.6 creates a .csv (text file comma delimited) file that can be opened directly in ACCPAC 5.6 and higher with no need for conversion.

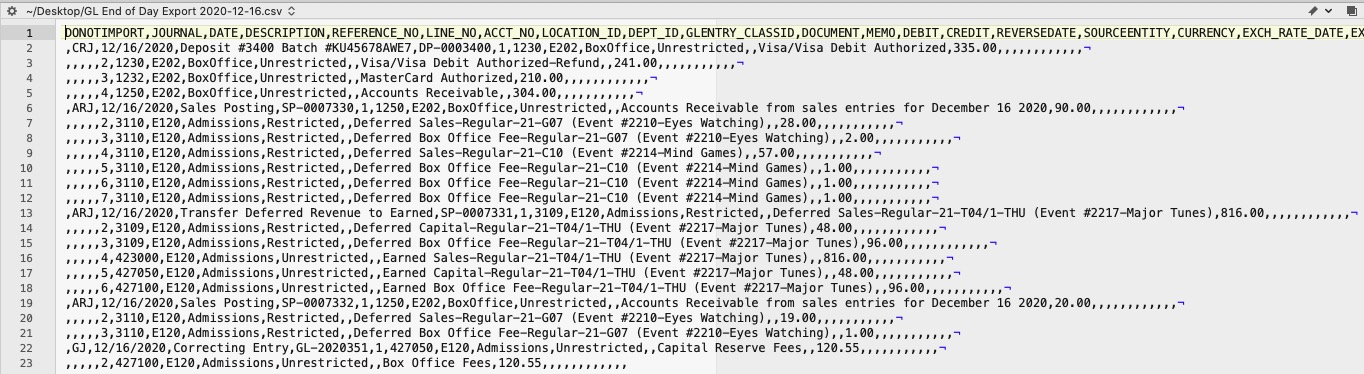

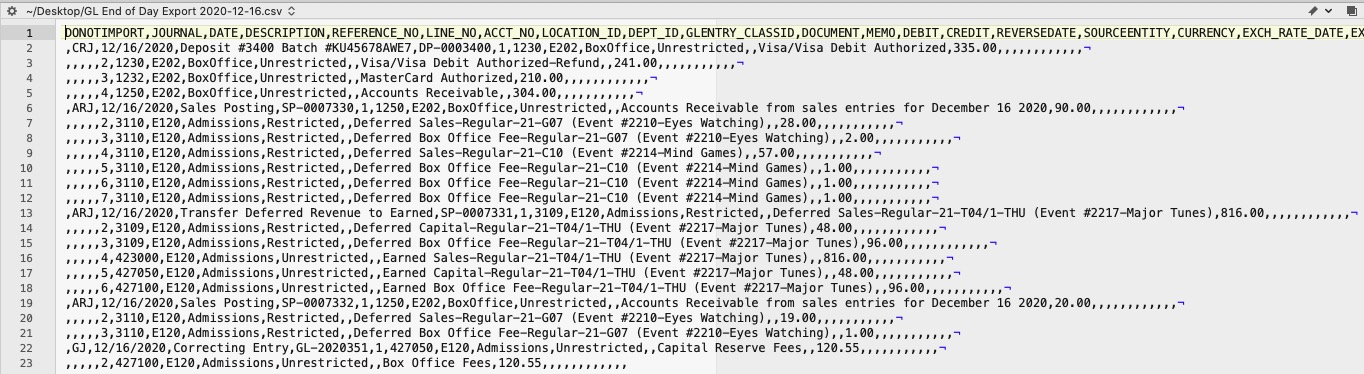

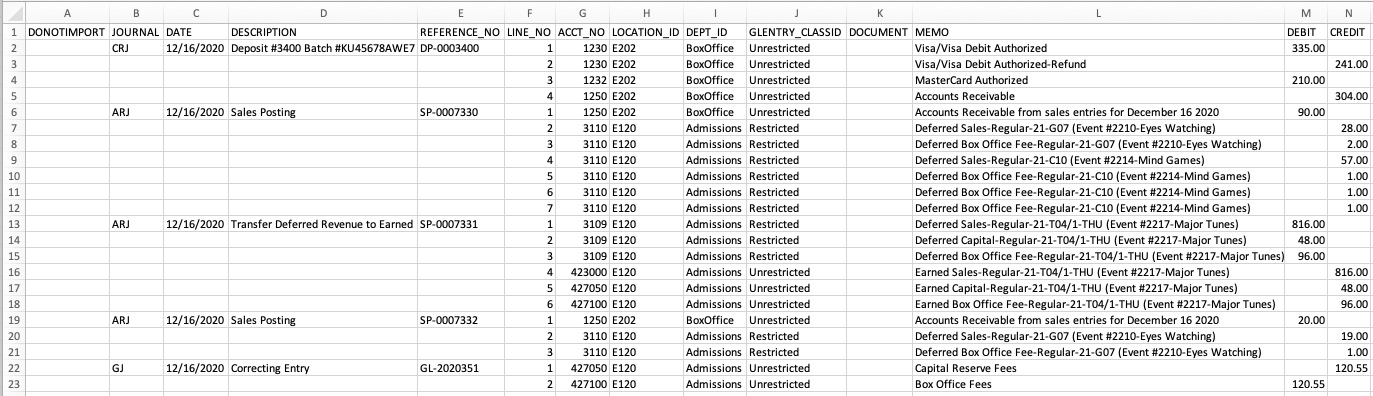

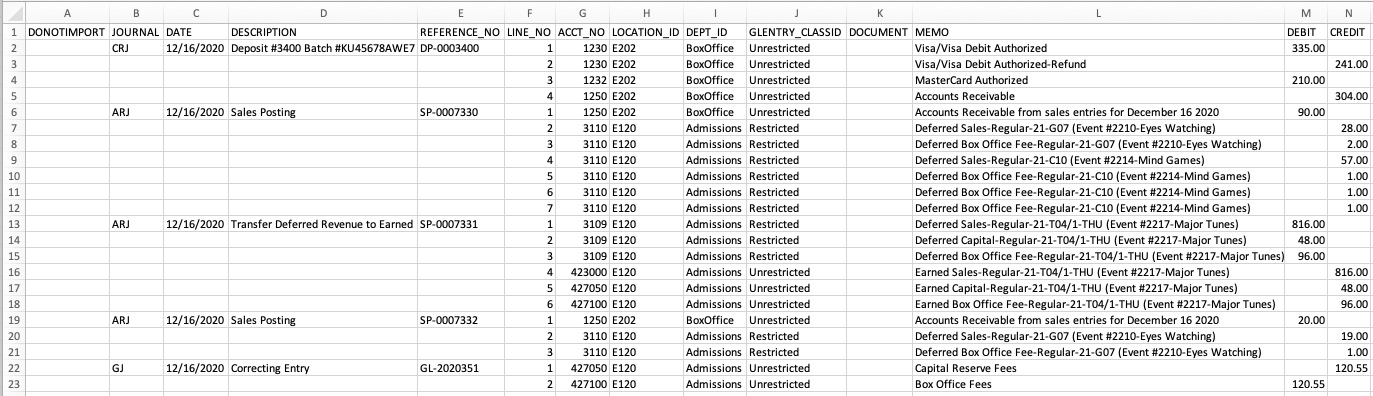

Sage Intacct G/L Export Format Top

Theatre Manager will create a comma-delimited text file (.csv) that can be used to import into Sage Intacct accounting software. Sage Intacct's ability to create unique accounts, locations, departments, and classes for each G/L account requires the setup of Theatre Manager's External Account field to be set in a specific format to accommodate the various aspects of the Intacct export file, prior to performing the first export.

The Sage Intacct exports each detail line within the G/L Entry. Each deposit and sales posting are exported as their own separate entry within the export file. This allows an exact match of each G/L Entry to crossover into Intacct (line for line).

Parts of the Sage Intacct Export File:

- DONOTIMPORT: Do Not Import flag

- Any row which starts with a # will be ignored during the Intacct import.

- Theatre Manager does NOT populate this field during the export process.

- JOURNAL: A valid Journal Type within Intacct representing the type of journal entry. The field is limited to 4 characters.

- The value ARJ for accounts receivable journal entries will be used for Sales Postings.

- The value CRJ for credit tax receipts journal entries will be used for Deposit Postings.

- The value GJ for general journal entries will be used for Manual G/L Entries.

- DATE: The Journal Entry Date for this G/L Entry, in a MM/DD/YYYY format.

- DESCRIPTION: The Journal Entry Description for this G/L Entry (e.g.

Sales Posting,Deposit Posting). The field is limited to 80 characters. - REFERENCE_NO: Journal Entry Reference Number. The Journal Number for each G/L Entry (e.g.

SP-0001318,DP-0001255,GL-2020351). - LINE_NO: A sequential Line Counter for each exported entry line, beginning at 1 and incrementing by 1 for each associated entry line. The Line Counter ID will reset back to 1 again for each new Sales Posting, Deposit Posting, or G/L Entry exported.

- ACCT_NO: The Intacct account number. Theatre Manager's External Account value (name or number) will be used to create the export file.

- LOCATION_ID: An associated Location ID to the Account Number. Theatre Manager's External Account value (name or number) will be used to create the export file.

- DEPT_ID: An associated Department ID to the Account Number. Theatre Manager's External Account value (name or number) will be used to create the export file.

- GLENTRY_CLASSID: An associated Class ID to the Account Number. Theatre Manager's External Account value (name or number) will be used to create the export file.

- DOCUMENT: The Document Reference for this G/L Detail Line. The field is limited to 30 characters. Theatre Manager does NOT populate this field during the export process.

- MEMO: The memo text for this G/L Detail Line. The field is limited to 1000 characters.

- DEBIT: The debit amount for this G/L Detail Line. A blank value is used for $0.00 amounts.

- CREDIT: The credit amount for this G/L Detail Line. A blank value is used for $0.00 amounts.

- REVERSEDATE: The Reverse Date for this G/L Entry, in a MM/DD/YYYY format. Theatre Manager does NOT populate this field during the export process.

- SOURCEENTITY: Refers to a valid Location within Intacct. The field is limited to 20 characters. Required only when the option to auto-create inter-entity transactions is enabled for journal entries and the journal entry is not balanced by location. Theatre Manager does not populate this field during the export process.

- CURRENCY: A valid Currency ID within Intacct. The field is limited to 40 characters. For any defined currency (e.g.

USDorEUR), blank denotes base currency. Use only in multi-currency companies. This field defines the transaction currency. If no field is defined here, the system uses base currency. Theatre Manager does NOT populate this field during the export process. - EXCH_RATE_DATE: The Exchange Rate Date indicator for this G/L Entry, in a MM/DD/YYYY format. A required field unless the EXCHANGE_RATE is provided. Use only in multi-currency companies. This field determines the exchange rate as of this date. Theatre Manager does NOT populate this field during the export process.

- EXCH_RATE_TYPE_ID: A valid Exchange Rate Type ID within Intacct. The field is limited to 40 characters. The default value is

Intacct Daily Rate, unless a custom exchange rate is defined as the default. Use only in multi-currency companies. Defines an optional custom exchange rate type. The system uses theIntacct Daily Rateif no optional one is defined here. Theatre Manager does NOT populate this field during the export process. - EXCHANGE_RATE: The Exchange Rate for this G/L Entry. The field is limited to 17 characters, not including decimal point. Defaults to the exchange rate of the CURRENCY on the EXCH_RATE_DATE for the EXCH_RATE_TYPE_ID. Must be a positive integer value. Use only in multi-currency companies. Overrides the default exchange rate, which is the product of the CURRENCY, EXCH_RATE_DATE and EXCH_RATE_TYPE_ID. Theatre Manager does NOT populate this field during the export process.

- STATE: The current State indicator for the G/L Entry. The values are

Draftfor draft state andPosted(default if not supplied) for posted state. Theatre Manager does NOT populate this field during the export process. - ALLOCATION_ID: A valid Allocation ID within Intacct. The field is limited to 50 characters. Theatre Manager does NOT populate this field during the export process.

- BILLABLE: The Billable for this G/L Entry.

The values are

Tfor billable andF(default if not supplied) for non-billable. Theatre Manager does NOT populate this field during the export process. - GLENTRY_CUSTOMERID: A valid Customer ID within Intacct. The field is limited to 20 characters. Theatre Manager does NOT populate this field during the export process.

- GLENTRY_VENDORID: A valid Vendor ID within Intacct. The field is limited to 20 characters. Theatre Manager does NOT populate this field during the export process.

Sage Intacct Account Format G/L Export Format Top

Theatre Manager's External Account number are required to be set up in a specific format to accommodate the various aspects of the Sage Intacct export file:

- ACCT_NO:

A23456789- The account number that transactions get posted to.- The format of this field is defined within Intacct. If Intacct's accounts include a dash (

-), include this dash in theC23456formatting at the appropriate position. For example:00-0000,000-000,0000-00etc.

- The format of this field is defined within Intacct. If Intacct's accounts include a dash (

- LOCATION_ID:

L2345- A predefined Location ID within Intacct. This ID is only required if Intacct requires it when using this account number. - DEPT_ID:

D23456- A predefined Department ID within Intacct. This ID is only required if Intacct requires it when using this account number. - GLENTRY_CLASSID:

C23456- A predefined Class ID within Intacct. This ID is only required if Intacct requires it when using this account number.

The format of the External Account varies based on the purpose of the GL Account. The format of this field is required to have a backslash (\) used as separator between fields. A leading or trailing backslash for the External Account field should NOT be added:

- (Accounts with No Location, No Dept, No Class) The field formation will be

A23456789 - (Accounts with Location, No Dept, No Class) The field formation will be

A23456789\L2345 - (Accounts with Location, Dept, No Class) The field formation will be

A23456789\L2345\D23456 - (Accounts with Location, Dept, Class) The field formation will be

A23456789\L2345\D23456\C23456 - (Accounts with No Location, Dept, No Class) The field formation will be

A23456789\\D23456 - (Accounts with No Location, No Dept, Class) The field formation will be

A23456789\\\C23456

Here's an example of asset account formats.

Here's an example of income account formats.

Solomon G/L Export Format Top

Theatre Manager will create a Microsoft Excel file that can be used to import into Solomon Accounting Software. Solomon's ability to create unique company names, accounts, projects, tasks, and sub accounts for each G/L account requires the setup of Theatre Manager's External Account field to be set in a specific format to accommodate the various aspects of the Solomon export file, prior to performing the first export.

The Solomon Accounting Software exports each detail line within the G/L Entry. Each deposit and sales posting are exported as their own separate entry within the export file. This allows an exact match of each G/L Entry to crossover into Solomon (line for line).

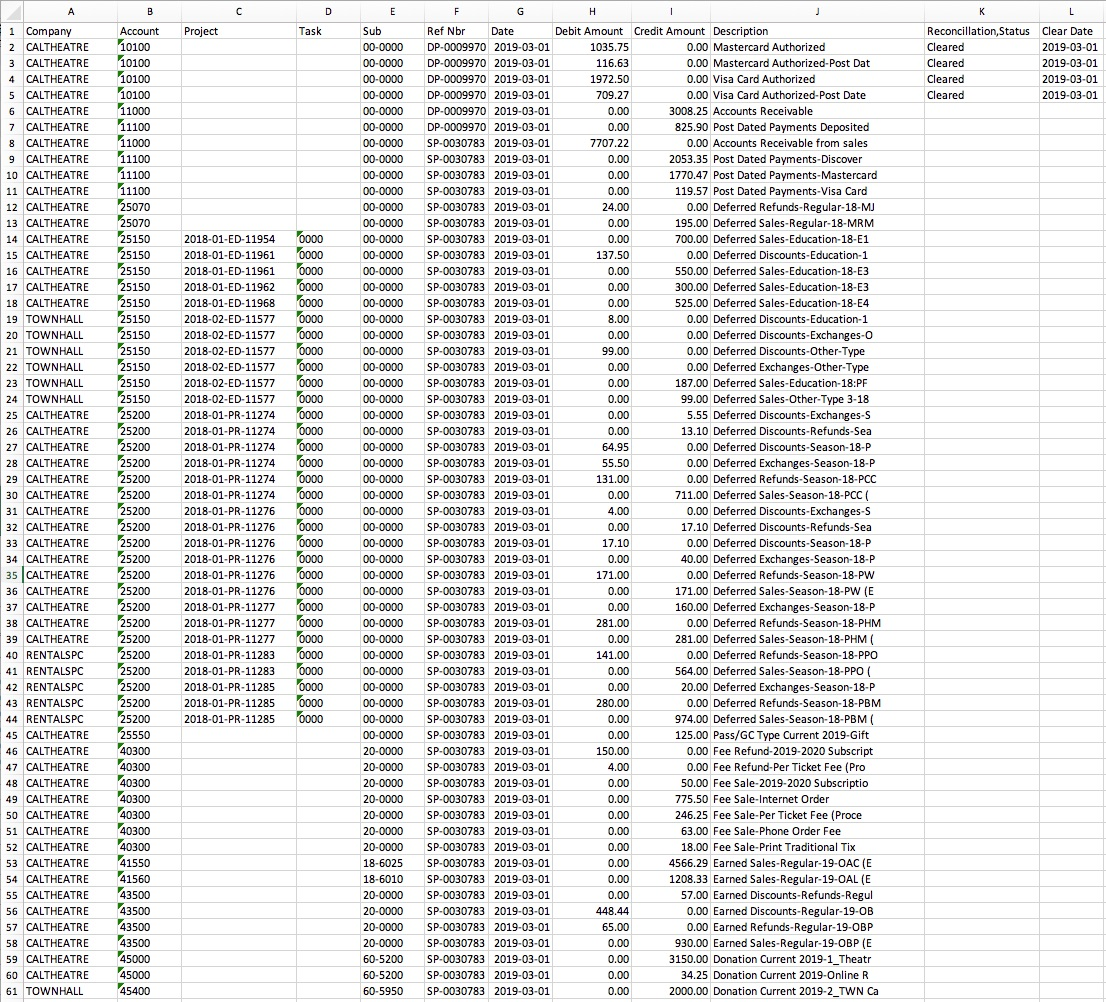

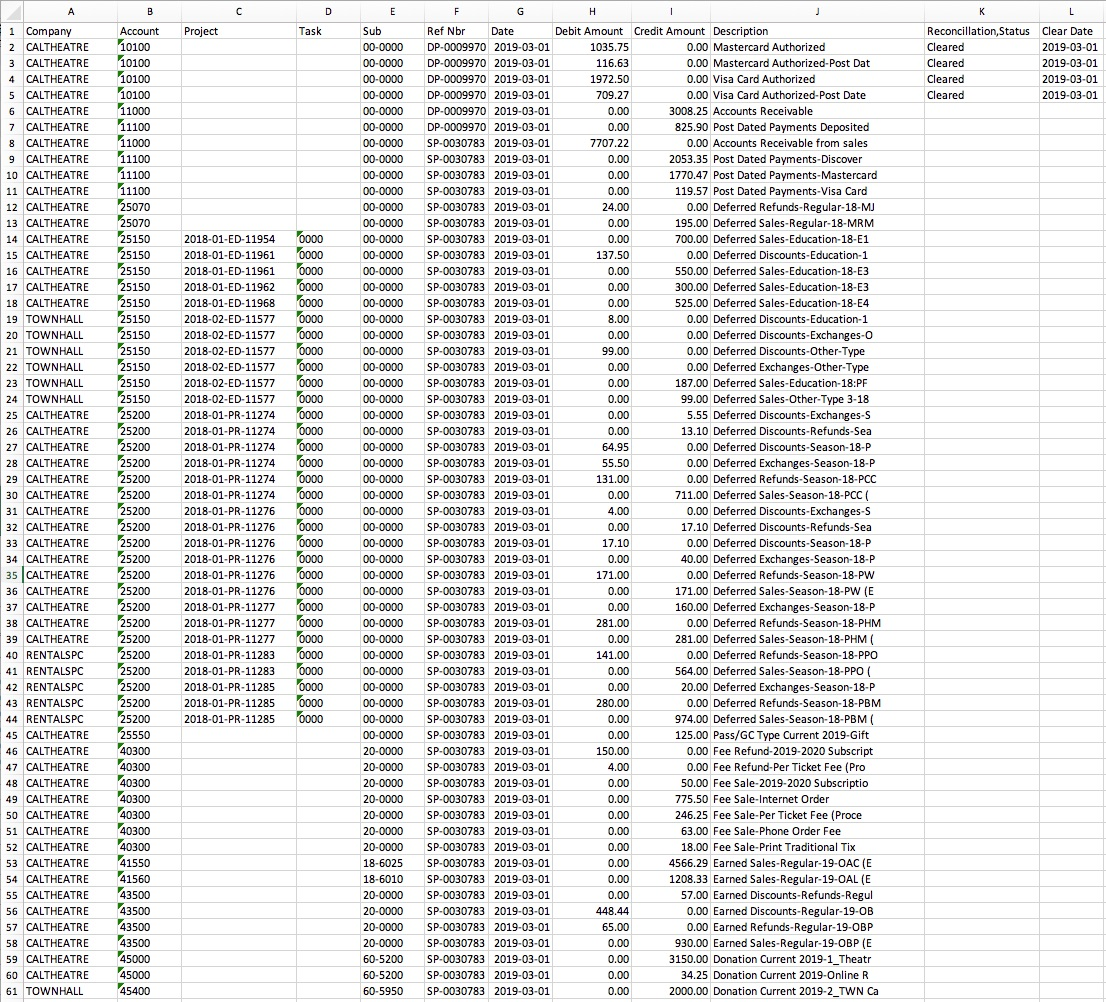

Parts of the Solomon Export File:

- Company: The company database that transactions get posted to. This description is defined within Solomon and may not match anything within Theatre Manager. Theatre Manager is able to maintain multiple company names that may be in Solomon. Theatre Manager will export the Company contained the External Account field.

- Account: A 5-digit account number. Theatre Manager's External Account value (name or number) will be used to create the export file.

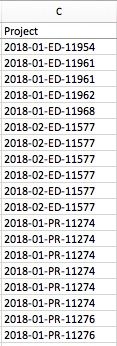

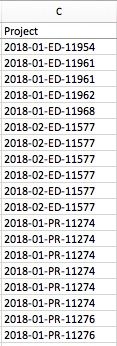

- Project: Project codes are setup within Solomon. Using Theatre Manager's External Account, the export process will create the Project Code for each event's sales. Refer to the section on Project Field Format on this page for more information.

- Only Ticketed Events have the ability to have project codes. This means Donations, Passes, Fees, Payments, Facility Projects, etc. will not have project codes.

- Cafe, Lounges, Bar Sales, Movies, etc. may be setup as ticketed events, but may not always have a project associated with them. During the setup process of the External Account field, the G/L accounts that do not have a project associated with them will not have a Location or Event Type Code assigned to them.

- Task: A 4-digit number. Task numbers are setup in Solomon.

- (Project) The value will default to the

0000. - (non-Project) The value will default to a blank field.

- (Project) The value will default to the

- Sub: A 6-digit sub account number. Sub account numbers are setup in Solomon.

- Ref Nbr: Journal Entry Reference Number. The Journal Number from the sales posting or deposit posting will be exported.

- Date: The Journal Entry Date, in YYYY-MM-DD format.

- Debit Amount: The debit amount of the transaction.

- Credit Amount: The credit amount of the transaction.

- Description: The memo text associated to this particular G/L transaction from Theatre Manager's journal entry. The field is limited to 30 characters.

*Reconcillation,Status: A reference to the reconciliation status for the bank deposit. This field is defaulted to aide in validating and importing data into Solomon.

- (Cash Type transactions) The value will default to the

Cleared. - (Non-Cash Type transactions) The value will default to a blank field.

- (Cash Type transactions) The value will default to the

- Clear Date: The date the transaction is cleared in Solomon. The date is always in YYYY-MM-DD format.

- (Cash Type transactions) The value will default to the Date column.

- (Non-Cash Type transactions) The value will default to a blank field.

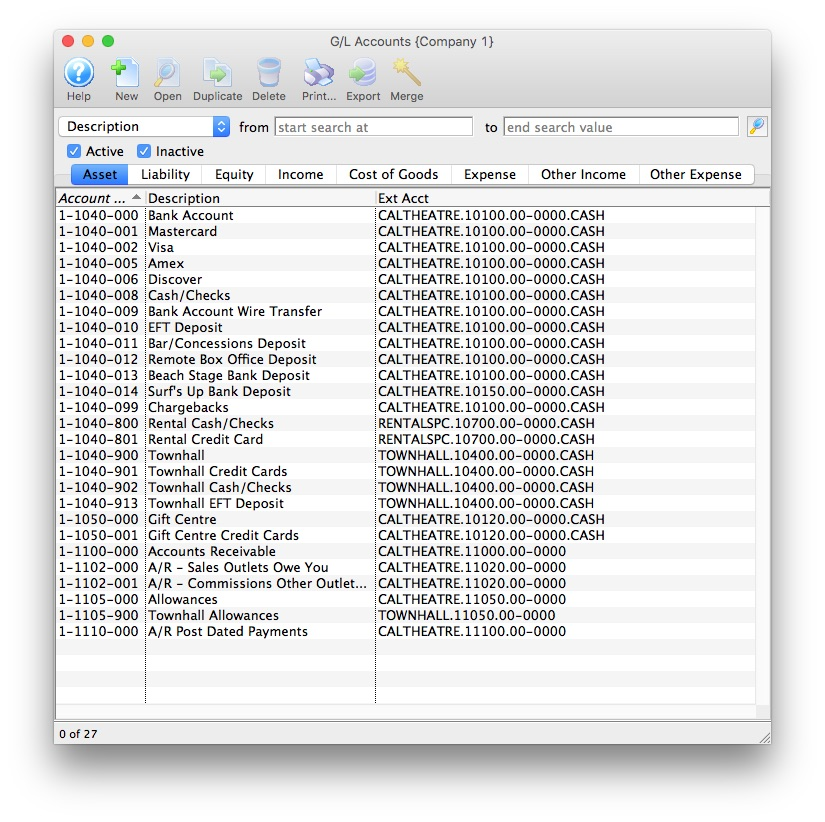

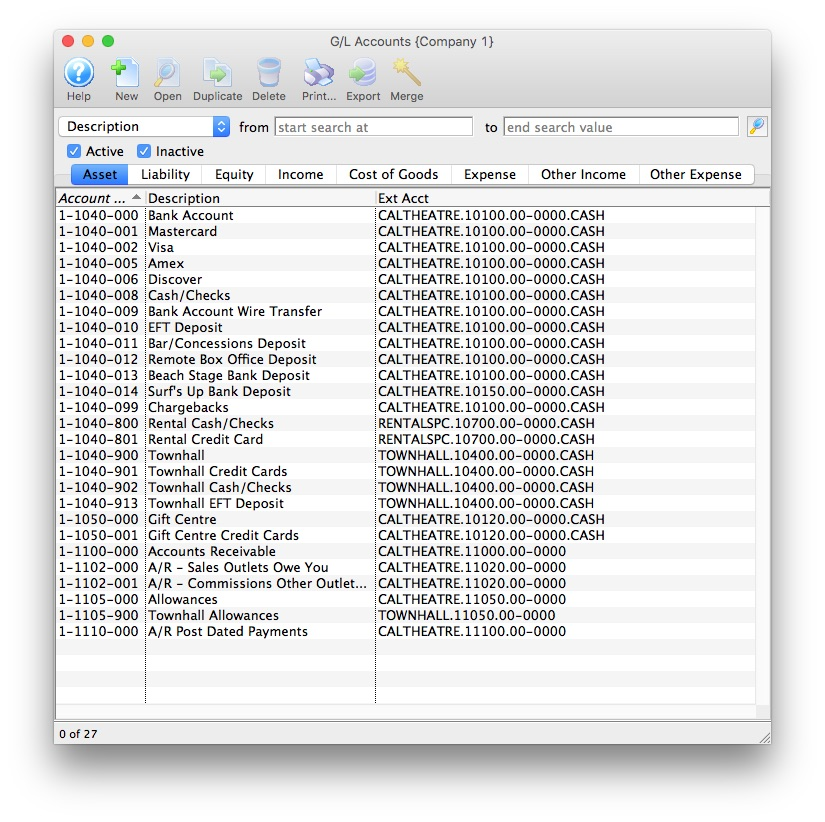

Solomon Field Formats Top

Theatre Manager's External Account number requires to be set up in a specific format to accommodate the various aspects of the Solomon export file:

*** Company:** A23456789 - The company database that transactions get posted to.

- Account:

B2345- A 5-digit account number. - Sub:

C23456- A 6-digit sub account number.- The format of this field is defined within Solomon. If Solomon's sub accounts include a dash (

-), include this dash in theC23456formatting at the appropriate position. For example:00-0000,000-000,0000-00, etc.

- The format of this field is defined within Solomon. If Solomon's sub accounts include a dash (

- Location:

L2- A 2-digit code representing the location where the event is taking place. - Event Type:

T2- A 2-character code representing the type of event. - Cash Type Transaction:

CASH- Include the valueCASHto represent this is a cash type account number.

The format of the External Account varies based on the purpose of the GL Account. The format of this field is required to have a period (.) used as separator between fields. A leading or trailing period for the External Account field should not be added:

- (Events with Projects) The field formation will be

A23456789.B2345.C23456.L2.T2 - (Events with No Projects) The field formation will be

A23456789.B2345.C23456 - (Cash Type Transactions) The field formation will be

A23456789.B2345.C23456.CASH

Here's an example of asset account formats.

Here's an example of income account formats.

The format of the Project field will always be Y234-L2-T2-E2345 using a dash (-) as a field separator. Theatre Manager will create a Project Code using the following contents:

- Program Year:

Y234- The Event Season Starting Year assigned to the event in Theatre Manager. - Location:

L2- The 2-digit code representing the location where the event is taking place, as defined in the External Account for the Event. - Event Type:

T2- The 2-character code representing the type of event, as defined in the External Account for the event. - Event #:

E2345- A 5-digit number representing the Event Sequence Number assigned to the event automatically by Theatre Manager.

Unit4 Business World G/L Export Format Top

Theatre Manager will create a fixed position text file (.txt) that can be used to import into Unit4 Business World accounting software. Unit4 Business World's ability to create unique accounts, locations, departments, and classes for each G/L account requires the setup of Theatre Manager's External Account field to be set in a specific format to accommodate the various aspects of the Unit4 Business World export file, prior to performing the first export.

The Unit4 Business World (formerly Agresso Financials) exports each detail line within the G/L Entry. This allows an exact match of each G/L Entry to crossover into Unit4 Business World (line for line).

Parts of the Unit4 Business World Export File:

- Batch Name: A pre-defined Batch Name identifier within Unit4 Business World representing the source of the journal entry. The field is limited to 7 characters. The default value is

ARTSMAN(to represent ArtsMan / Arts Management Systems Ltd). - Transaction Series: A pre-defined Transaction Series Code within Unit4 Business World representing the type of journal entry. The default value is

TMTMGLSA(whereTMis representing Theatre Manager). - GL Account Code: The Unit4 Business World account number. Theatre Manager's External Account value (name or number) will be used to create the export file.

- Cost Centre: Mandatory. A valid Cost Centre within Unit4 Business World. The field is limited to 4 characters. Theatre Manager's External Account value (name or number) will be used to create the export file.

- Project: Optional. A valid Project within Unit4 Business World. The field is limited to 16 characters. Theatre Manager's External Account value (name or number) will be used to create the export file.

- Location: Optional. A valid Location within Unit4 Business World. The field is limited to 8 characters. Theatre Manager's External Account value (name or number) will be used to create the export file.

- Payment Type: Optional. A valid Payment Type within Unit4 Business World. The field is limited to 11 characters. Theatre Manager's External Account value (name or number) will be used to create the export file.

- If this is a deposit posting (e.g.

DP-0001255) and a value is supplied, it maps to specific payment types (e.g.VS,MC,AMEX, etc.) within Unit4 Business World. - If this is a sales posting (e.g.

SP-0001318,GL-2020351) and a value is supplied, it applies to specific revenue items to identify the type of revenue. Unit4 Business World uses this field for duo purposes depending on the G/L Account being referenced.

- If this is a deposit posting (e.g.

- Fund: Mandatory. A valid Fund within Unit4 Business World. The field is limited to 4 characters. Theatre Manager's External Account value (name or number) will be used to create the export file.

- Revenue Type: Optional. A valid Revenue Type within Unit4 Business World. The field is limited to 8 characters. Theatre Manager's External Account value (name or number) will be used to create the export file.

- Currency: A valid Currency Type ID within Unit4 Business World. The field is limited to 4 characters. the default value is

CADorUSD. - Data Type: Sets a preference value used during the import process to allow the import routines to know the data types that will be included within the import tables. This field is set to the default value of

0. - Amount in Local Currency: The amount of the transaction. Debit amounts are always positive. Credit amounts are always negative.

- Amount in Local Currency if Converted to Foreign Currency: The amount of the transaction. Debit amounts are always positive. Credit amounts are always negative. Use only in multi-currency companies. This field determines the exchange amounts for the Period Start and Period End dates. Theatre Manager sets this value to be the same as the Amount in Local Currency.

- Account Description: The G/L Account Description for this G/L Account. The field is limited to 50 characters.

- Period Start: The Journal Entry Date for this G/L Entry, in a YYYYMMDD format.

- Period End: The Journal Entry Date for this G/L Entry, in a YYYYMMDD format.

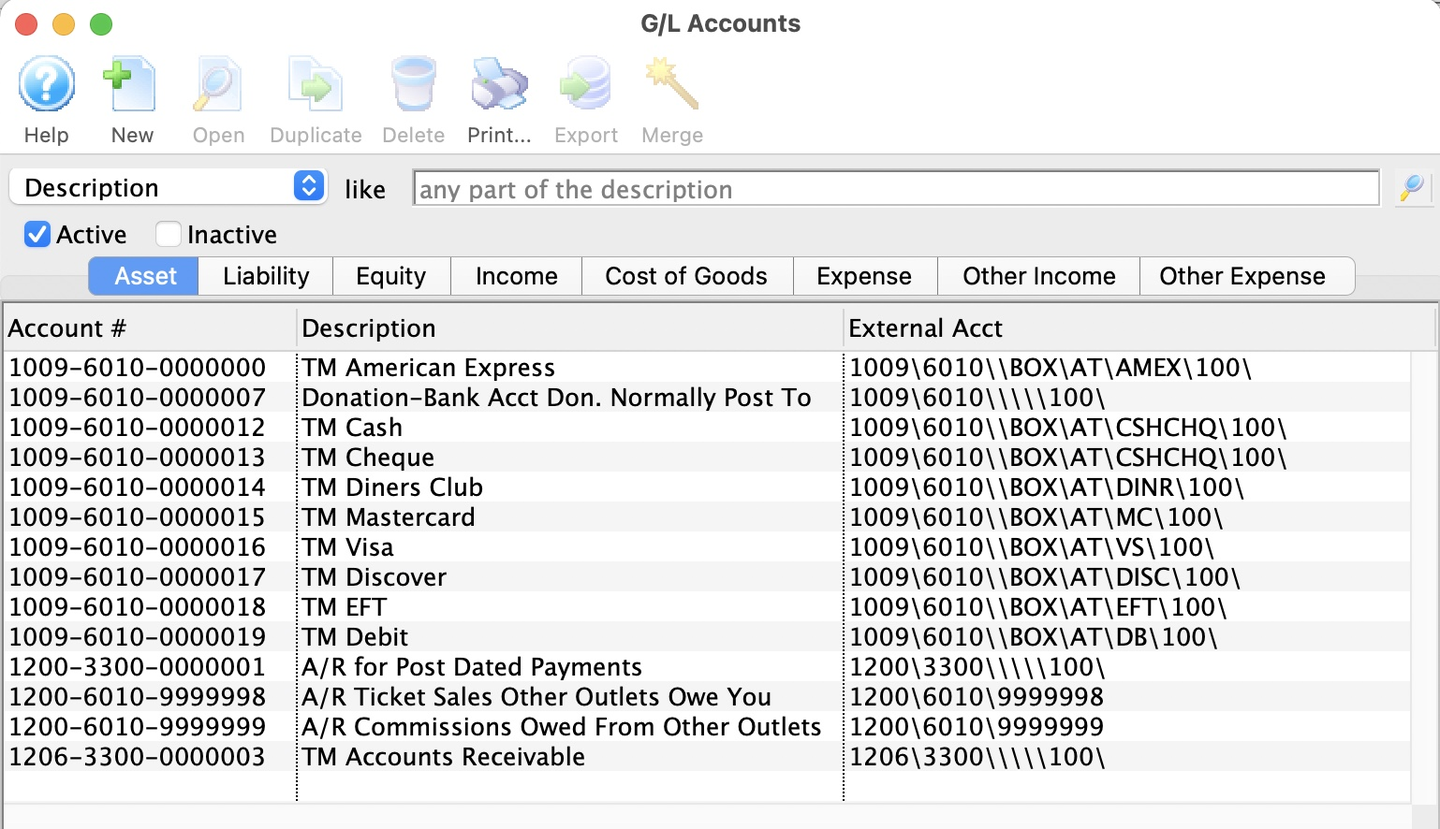

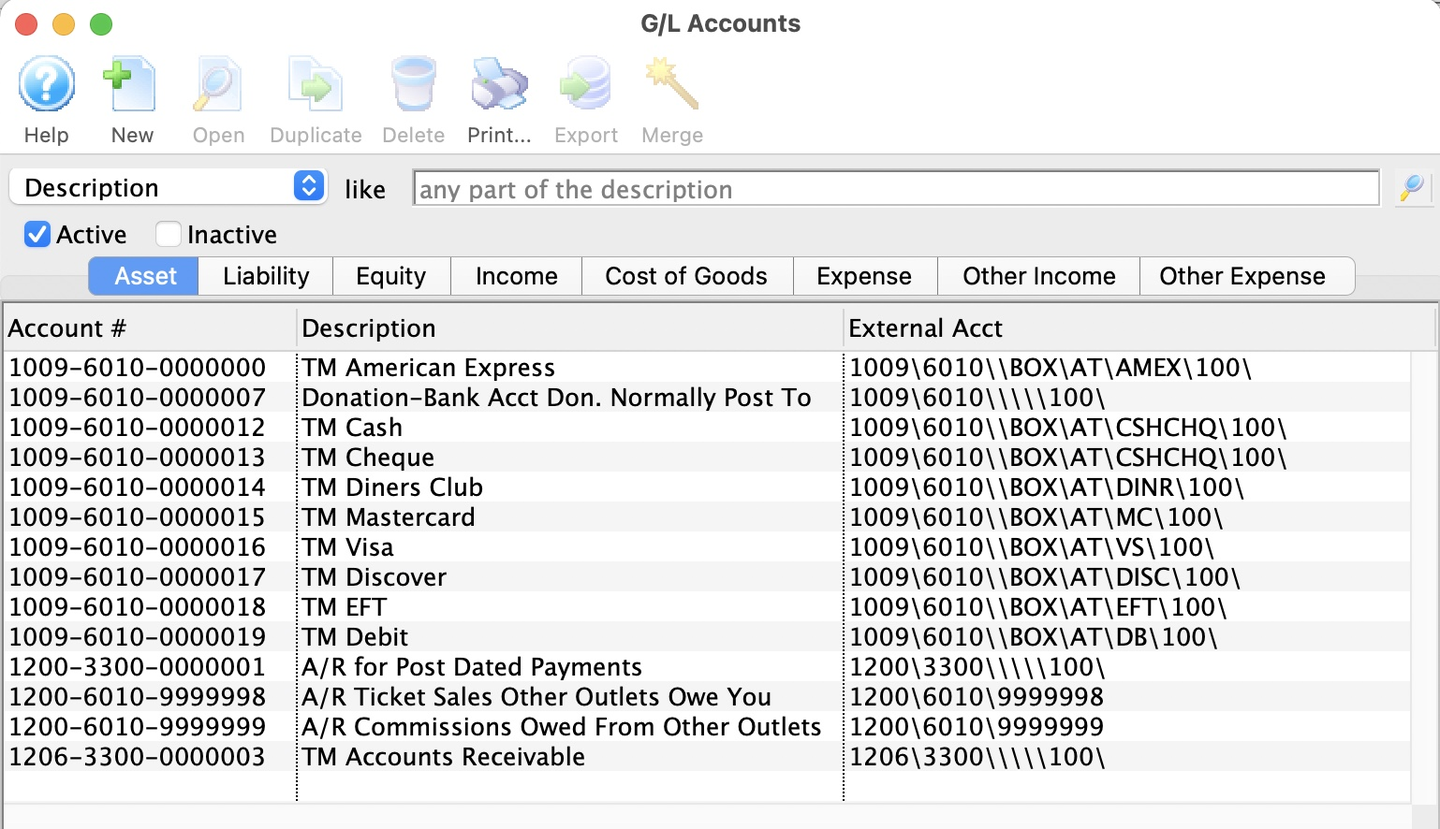

Unit4 Account Format Top

Theatre Manager's External Account number are required to be set up in a specific format to accommodate the various aspects of the Unit4 Business World export file:

- GL Account Code:

4190- The Account Number that transactions get posted to. The account number is mandatory. - Cost Centre:

3205- A predefined Cost Centre within Unit4 Business World. This ID is mandatory. - Project:

112204- A predefined Project within Unit4 Business World. This ID is optional. - Location:

999- A predefined Location within Unit4 Business World. This ID is optional. - Revenue Type:

888- A predefined Revenue Type within Unit4 Business World. This ID is optional. - Payment Type:

777- A predefined Payment Type within Unit4 Business World. This ID is optional. - Fund:

100- A predefined Fund within Unit4 Business World. This ID is mandatory.

The format of the External Account varies based on the purpose of the GL Account. The format of this field is required to have a backslash (\) used as separator between fields. A leading backslash for the External Account field should not be added.

- (Accounts with all fields provided) The field formation will be

4190\3205\112204\999\888\777\100 - (Accounts with GL, Cost Centre, Fund) The field formation will be

4190\3205\\\\\100 - (Accounts with GL, Cost Centre, Payment Type, Fund) The field formation will be

4190\3205\\\\VS\100

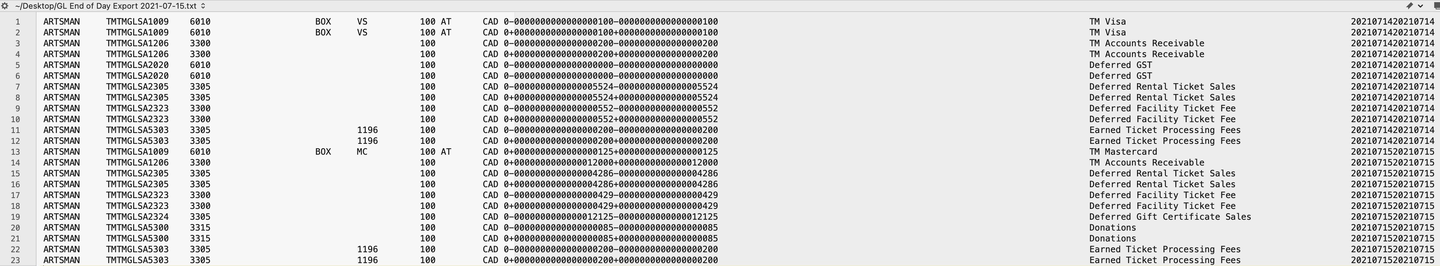

Here's an example of asset account formats.

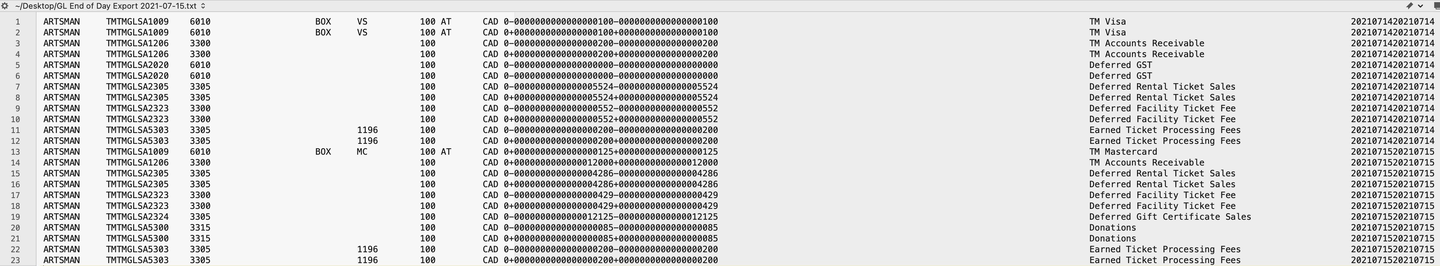

Here's an example of income account formats.