Theatre Manager is designed to be used in conjunction with the organization's existing financial accounting system. Information generated from the Theatre Manager General Ledger provides:

- Deposit and Sales Entries into your financial accounting system, including future liabilities for deferred revenues like gift certificates, events or donations.

- A list of Accounts Receivables by patron

- Tax liability information

- Event / Play revenue breakdown reports, including order fees and exchange fees

Sales are controlled and accounted for in the General Ledger module and display numerous variations of revenue breakdown. Implementing the General Ledger requires setting up a simplified chart of accounts, creating general journal entries, and posting the entries to the General Ledger. The General Ledger module provides information based on transactions which have been posted.

The design of the General Ledger Chart of Accounts enables the ability to have all the detailed information remain in Theatre Manager, while your financial package (Quickbooks Online, SAGE, etc.) retain top-level summary information.

Accrual Based Accounting reflects the understanding that the economic effect of a revenue generally occurs when the event occurs (e.g .tickets bought), not when cash is received. This approach supports deferred accounting, management of receivables, post dated payments and other features. In the US, the IRS requires accrual accounting for 'C' organizations under most circumstances and GAAP/FASB requires it. Canada Revenue Agency rules are similar.

Theatre Manager is designed exclusively around Accrual Accounting principles.

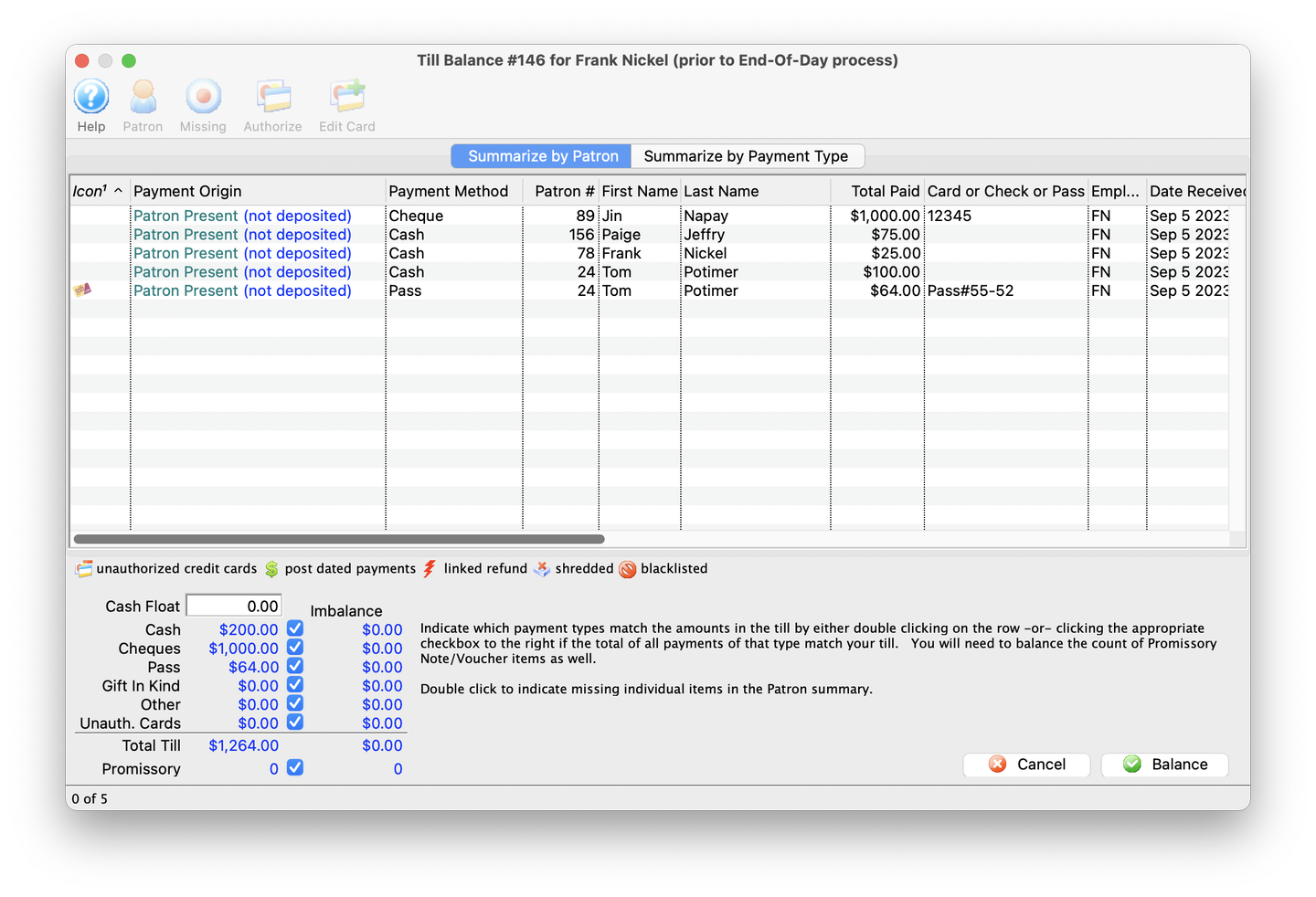

Till Balance Top

The till balance feature allows you to have all employees balance their own tills at the end of each shift. This speeds up the End-of-Day process and removes room for error when employees may have already left for the day.

When a shift's till is created, it is assigned a unique number. If the employee has entered one or more payments since the last time they balanced a till, and the payments have not been posted in the End-of-Day (EOD) process, the employee has the option to:

- Assign the payments to the same till as they previously balanced. This means that all money taken across a number of days is simply being lumped together into one till #.

- Create a new shift till for the unbalanced payments. This means you are putting new money into a new till #.

- A combination of the above by putting some money into an existing till and the rest into a new till.

Regardless of the option the employee takes, it is the same amount of money to the EOD process. Till #'s can be used for your internal processing as it means nothing to EOD other than that it lets you segregate money by shift if needed.

Get starting processing a till with these how-to guide steps.

End Of Day Top

Completing an End of Day closes out the daily transactions and deposits credit cards into the company's bank account. If running End of Day happens on a frequent basis, for example at the end of every business day, there should be little to no problems with the annual audit. This is based on making the GL entries in the accounting software exactly the same as Theatre Manager creates them.

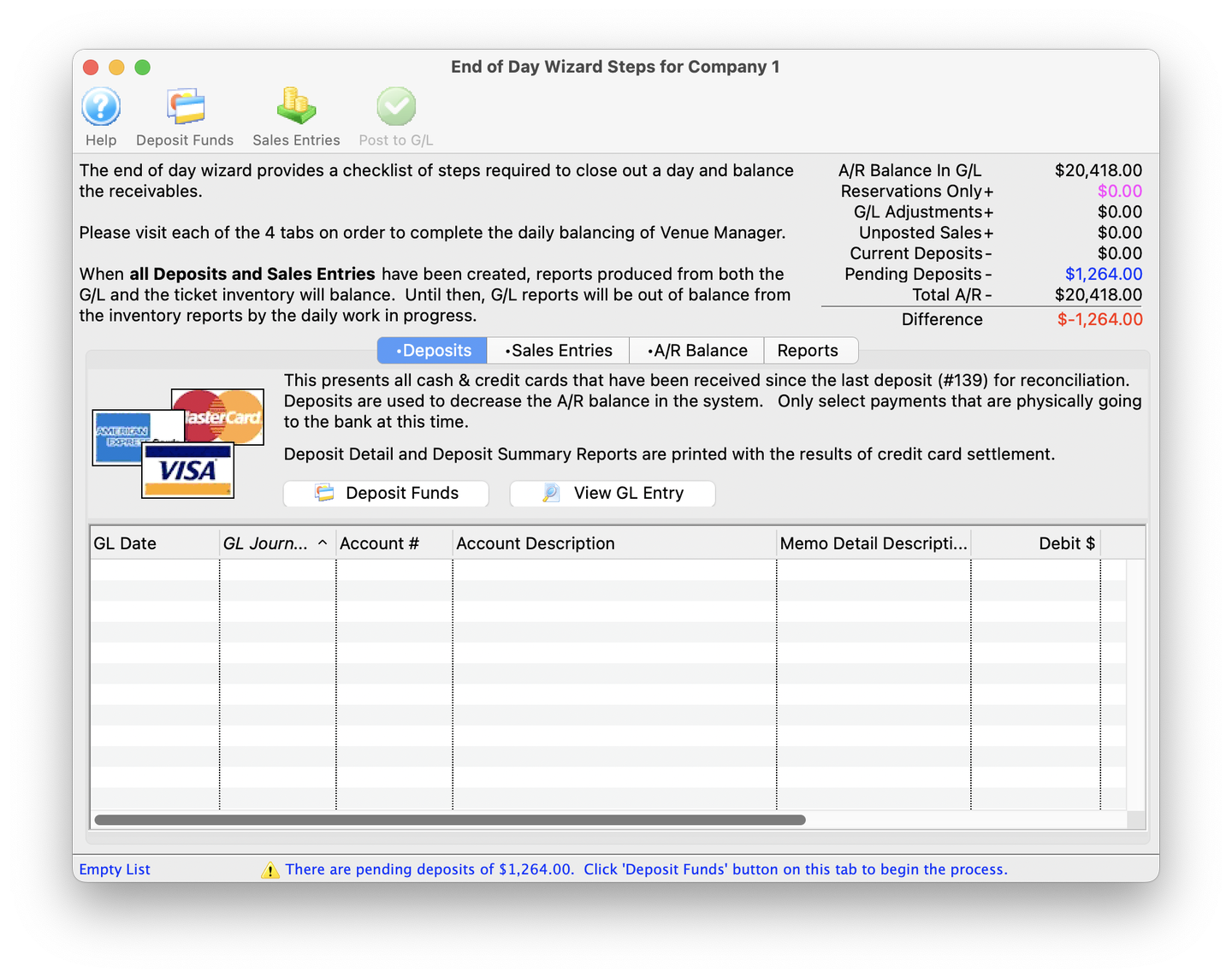

The End of Day Wizard does the following in the system:

- Cashes out all tills

- Deposits credit card sales into an organizations bank account

- Counts the inventory given out that day (tickets, memberships, donations, etc.)

- Identifies any imbalances between your credit card processor and Theatre Manager's credit card transactions.

- Prompts and pulls account reports for bank deposits, audit tracking, and bookkeeping needs.

The EOD process takes about 15 minutes and sales can continue while being run. It is best run at the close of business or the beginning of the next day.

A complete EOD has four parts to it:

- Deposits

- This deposits credit card payments.

- Run this step as many times as is needed in a day, independently of the following steps.

- Sales Entries

- This step does several things, including:

- Create sales transactions for online orders

- Create G/L entries for all sale transactions since the last EOD

- Find all ticketed events due to be rolled over from deferred to earned accounts

- Run regular database cleanup activities (e.g. removing patrons from mail lists if they have not double opted-in, deleting old shopping carts, deleting old eblasts and letter records, etc.)

- Run this step as many times as you need per day, however:

- A sales entry is automatically created for each revenue date since the last sales entry was created

- Sales entries should be created prior to entering new sales/payments (except for corrective entries) to prevents combining deposits and sales for two periods in the same G/L entry

- This step does several things, including:

- Posting to the General Ledger

- This records detailed accounting transactions (the credits and debits), shifting them from journal entries to permanent G/L records.

- Limit to no more than once a day.

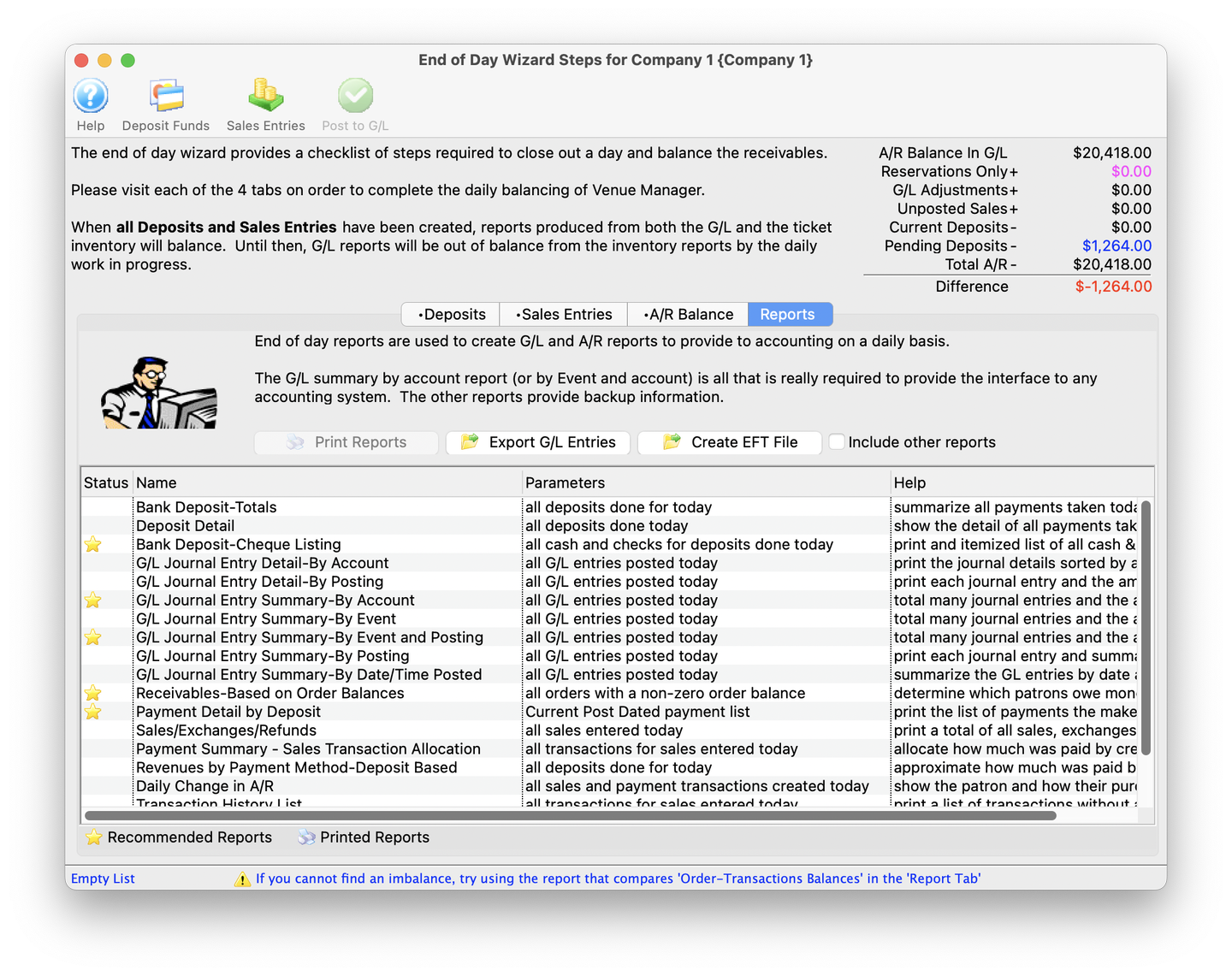

- Reports

- This step produces summary and detail reports, including complete data exports as needed for your accounting software, for the aggregate EOD posting.

- Limit to no more than once a day because the report criteria aggregates all daily activity for your convenience. While you can create manual criteria in the same reports in the Reports Window to separate out multiple postings per day, this is not recommended as a regular practice.

To get started using the EOD Wizard, read about how to run EOD.